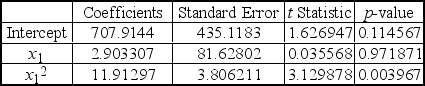

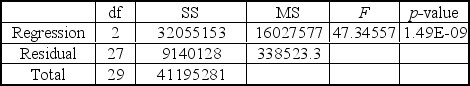

A local parent group was concerned with the increasing school cost for families with school aged children.The parent group was interested in understanding the relationship between the

The academic grade level for the child and the total costs spent per child per academic year.They

Performed a multiple regression analysis using total cost as the dependent variable and academic

Year (x1) as the independent variables.The multiple regression analysis produced the following

Tables.

Using = 0.05 to test the null hypothesis H0: 1 = 0,the critical t value is ____.

Definitions:

Face Value

The nominal or dollar value printed on a financial instrument, such as a bond or stock certificate, representing the amount to be paid at maturity or the value of a share.

Straight Bond Value

The present value of a bond's future interest payments and its redemption value at maturity, assuming it has no special features.

Black-Scholes Option Pricing Model

A mathematical model for pricing an options contract by estimating the variation over time of financial instruments.

Option to Buy

A contract that gives the holder the right, but not the obligation, to purchase a specified asset at a set price within a specific timeframe.

Q4: A researcher believes that a variable

Q6: When a false null hypothesis is rejected,the

Q11: If I invest $100 at the end

Q22: In a multiple regression analysis with N

Q34: Jim Royo,manager of Billings Building Supply

Q35: Sarah Soliz,Director of Quality Programs,is designing <img

Q36: In testing hypotheses,the researcher initially assumes that

Q39: Collinsville Construction Company purchases steel rods

Q46: Use the tables to determine the answers

Q69: The Kruskal-Wallis test is to be used