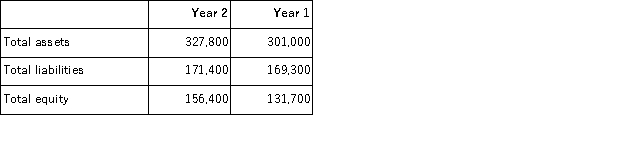

Refer to the following selected financial information from Keller Company. Compute the company's debt to equity for Year 2.

Definitions:

Allowances

Reductions from the gross amount due to defects or allowances for customer discounts, contributing to the net sales figure.

W-4 Form

A tax form used by employees to indicate their tax situation to their employer, such as number of dependents and marital status, affecting the amount of federal income tax withheld from their pay.

FICA-Medicare

A federal payroll tax that funds Medicare, the U.S. health insurance program for individuals aged 65 and over or who meet other specific criteria.

Gross Wages

Gross Wages refer to the total amount of compensation earned by an employee before any deductions or taxes are taken out.

Q3: The staff of Ms.Tamara Hill,VP of Technical

Q7: What proportion of San Diego's registered voters

Q22: The following graphic of residential housing data

Q38: Numbers which are used only to classify

Q55: The staffs of the accounting and the

Q76: A local manufacturing plant randomly selected 200

Q125: The right of common shareholders to purchase

Q135: West Company declared a $0.50 per share

Q173: Gershwin Company reported net income of $428,000

Q233: Stocks with a price-earnings ratio less than