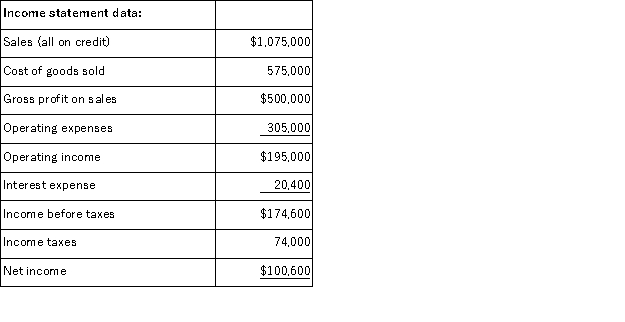

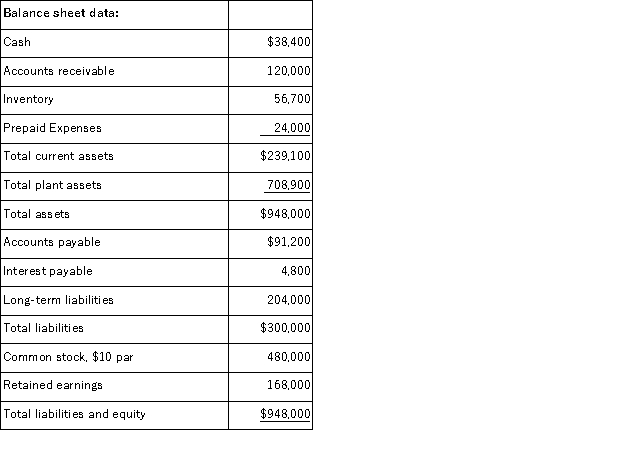

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days' sales uncollected.

(d) Inventory turnover. (Assume the prior year's inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on common stockholders' equity. (Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only common stock outstanding).

(h) Price earnings ratio. (Assume the company's stock is selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)

Definitions:

Quantity Demanded

The aggregate quantity of a product or service that buyers are prepared and capable of buying at a specific price.

Quantity Demanded

The sum of a good or service desired by consumers at a certain price within a set period.

Price Decrease

A reduction in the cost at which goods or services are sold in the market.

Demand

The capacity for purchasing goods or services that people demonstrate readiness and financial ability for, at diverse price levels, during a certain timeframe.

Q1: A corporation issued 5,000 shares of $10

Q36: All of the following statements regarding a

Q40: The payment of cash dividends to shareholders

Q46: Given that two events,A and B,are independent,if

Q47: A ratio expresses a mathematical relation between

Q55: The higher the accounts receivable turnover, the

Q145: Stock that was reacquired and is still

Q181: The ability to provide financial rewards sufficient

Q217: A corporation received its charter and began

Q220: The return on total assets can be