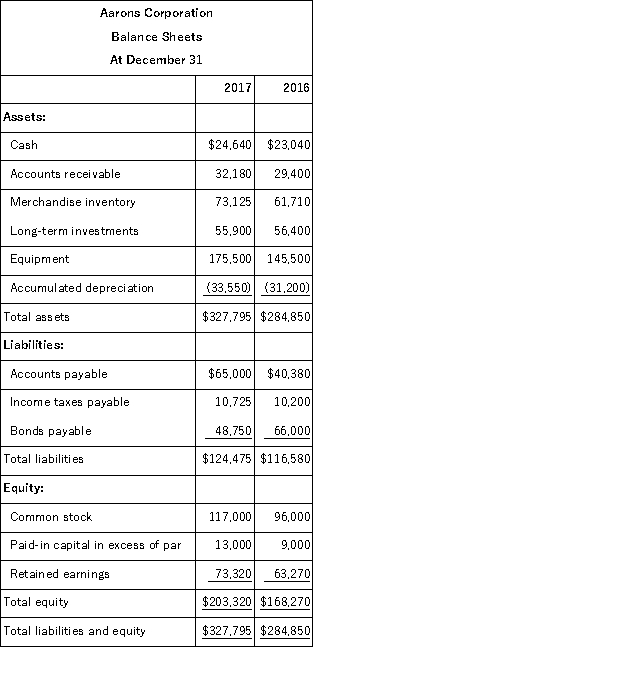

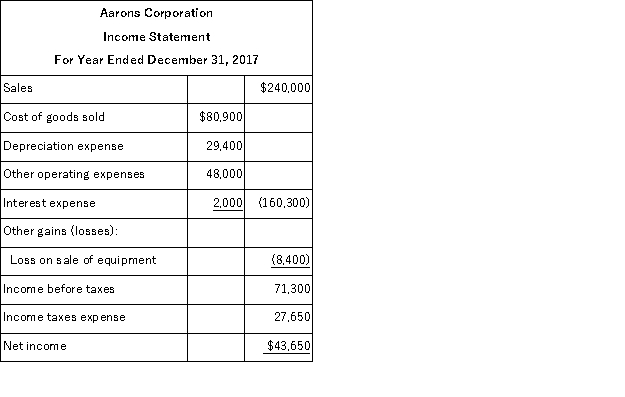

The following information is available for the Aarons Corporation:

Additional information:

Additional information:

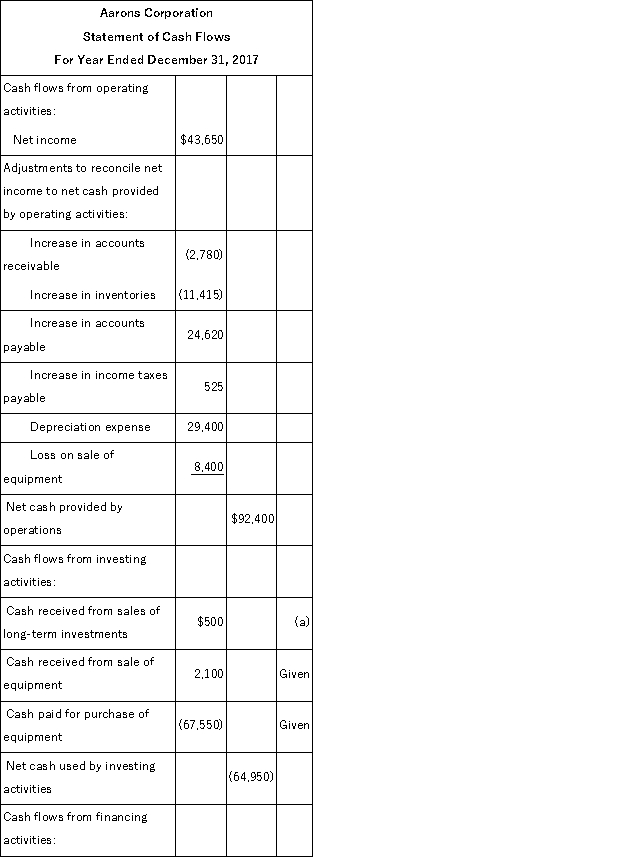

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 2017 using the indirect method.

Definitions:

Q2: An advantage of common-size statements is that

Q25: Guidelines (rules-of-thumb) are general standards of comparison

Q28: A level of data measurement that has

Q75: The base amount for a common-size balance

Q103: Selected current year end financial information for

Q169: Three of the most common tools of

Q201: The stockholders' equity section of a corporation's

Q208: Financing activities include receiving cash dividends from

Q220: On January 1, a company issues bonds

Q229: The contract rate of interest is the