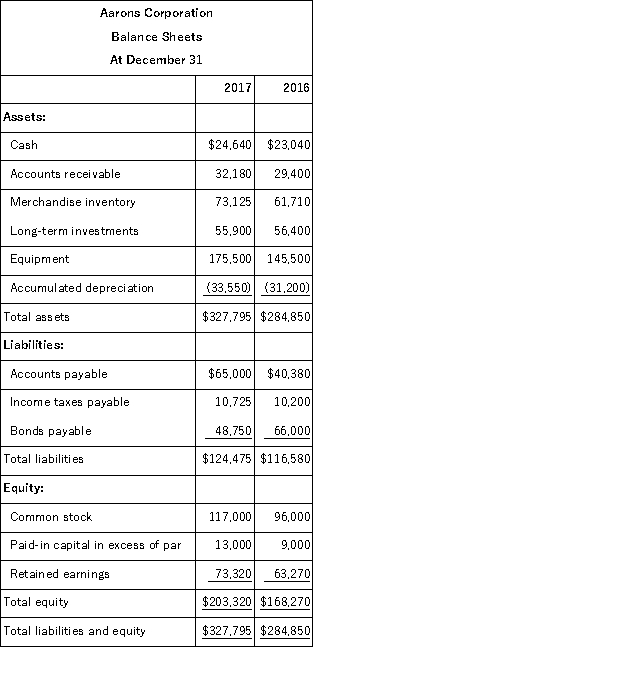

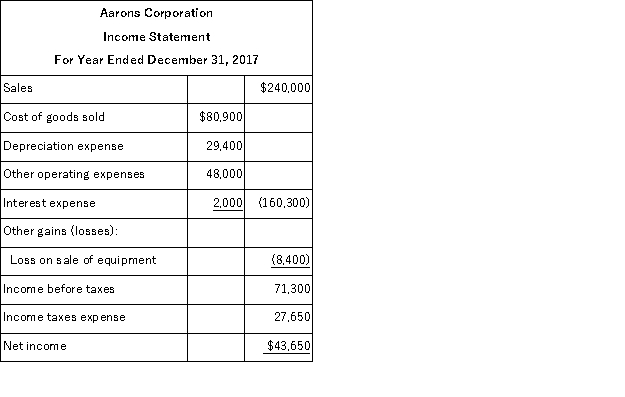

The following information is available for the Aarons Corporation:

Additional information:

Additional information:

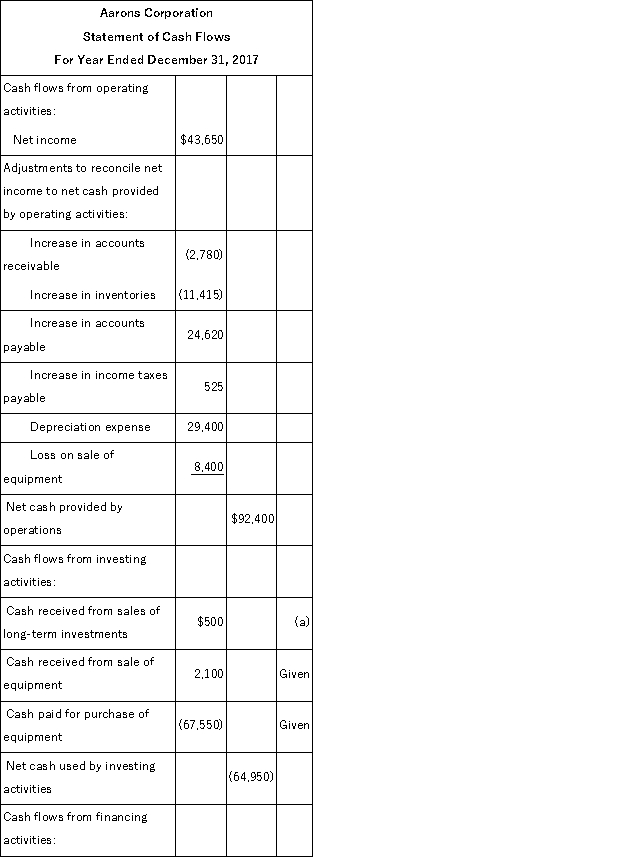

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 2017 using the indirect method.

Definitions:

Treasury Stock

This refers to shares of stock that were issued and later reacquired by the issuing corporation. It is often held to utilize in future acquisitions or to reissue to employees as part of compensation packages.

Par Common Stock

The nominal or face value assigned to a share of common stock by the company's charter.

Prior Period Adjustment

An adjustment made to the financial statements to correct an error found in a period that has already been reported.

Depreciation Expense

Depreciation expense represents the systematic allocation of the cost of a tangible asset over its useful life, reflecting wear and tear, obsolescence, or other reductions in value.

Q12: To compute trend percentages the analyst should:<br>A)Select

Q23: Gathering data from a sample to reach

Q39: The lowest level of data measurement is

Q62: The factor for the present value of

Q70: A corporation had current year net income

Q90: A corporation issued 6,000 shares of its

Q124: The dividend yield is computed by dividing:<br>A)Annual

Q138: Define the cash flow on total assets

Q142: The debt-to-equity ratio is calculated by dividing

Q167: Refer to the following selected financial information