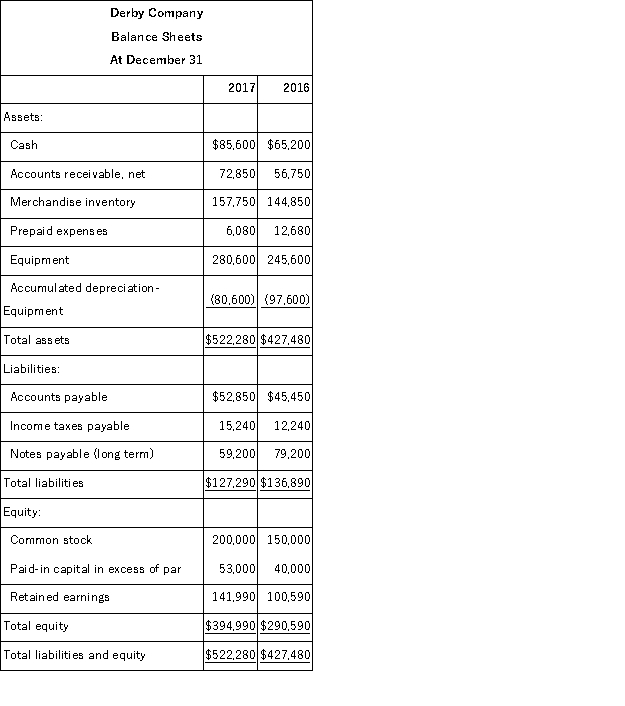

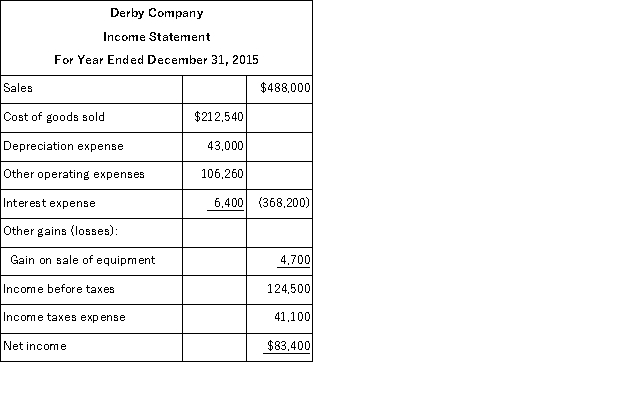

Use the following financial statements and additional information to (1) prepare a statement of cash flows for the year ended December 31, 2017 using the indirect method, and (2) compute the company's cash flow on total assets ratio for 2017.

Additional Information:

Additional Information:

a. A $20,000 note payable is retired at its carrying value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Definitions:

Continuous Probability Distributions

Probability distributions in which the data can take infinitely many values within a given range.

Poisson Probability Distribution

A discrete probability distribution that expresses the probability of a given number of events occurring in a fixed interval of time or space, assuming these events occur with a known constant mean rate and independently of the time since the last event.

Binomial Probability Distribution

A probability distribution detailing the chances of a variable assuming one of two independent values based on specific parameters or assumptions.

Normal Probability Distribution

A bell-shaped probability distribution characterized by its mean and standard deviation, describing how random variables are distributed.

Q2: Business activities that generate or use cash

Q3: The building blocks of financial statement analysis

Q10: A particular feature of callable bonds is

Q33: A company's calendar-year financial data are shown

Q38: Cash paid for merchandise is an operating

Q73: A company issued 10-year, 9% bonds with

Q99: The comparison of a company's financial condition

Q119: Financial statement analysis lessens the need for

Q147: Use the balance sheets of Plover Company

Q205: Zhang Company has a loan agreement that