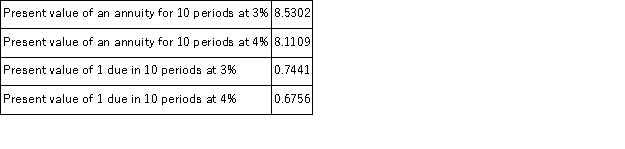

On January 1, a company issues 8%, 5 year, $300,000 bonds that pay interest semiannually. On the issue date, the annual market rate of interest is 6%. The following information is taken from present value tables:  What is the issue (selling) price of the bond?

What is the issue (selling) price of the bond?

Definitions:

Put-Call Parity

A fundamental principle in options pricing that establishes a specific relationship between the prices of European put and call options with the same strike price and expiration date.

European Put Option

A financial contract that gives the holder the right, but not the obligation, to sell an underlying asset at a specified price on the expiration date.

Exercise Price

The price at which the holder of an option can buy (for a call option) or sell (for a put option) the underlying security.

Currency-Translated Options

Options that involve the right to buy or sell a specified amount of one currency for another at a predetermined exchange rate during a specified period.

Q26: Trey Morgan is an employee who is

Q58: Martinez owns an asset that cost $87,000

Q82: Torino Company has 10,000 shares of $5

Q108: Stocks that pay relatively large cash dividends

Q110: When analyzing the changes on a spreadsheet

Q135: West Company declared a $0.50 per share

Q136: An employee earned $128,500 working for an

Q194: On January 1 of Year 1, Congo

Q205: An employee earns $5,500 per month working

Q227: Plant assets are defined as:<br>A)Tangible assets that