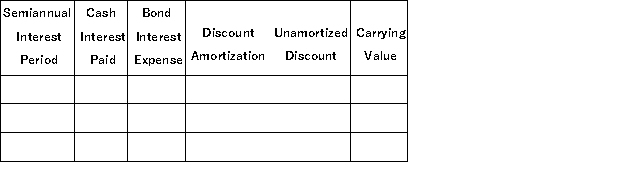

A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective interest amortization method. Interest is paid semiannually each June 30 and December 31.

(1) Prepare an amortization table for the first two payment periods using the format shown below:  (2) Prepare the journal entry to record the first semiannual interest payment.

(2) Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Proposed Project

A structured series of related activities scheduled for completion within a set period, while staying within defined budgetary and other restrictions.

Final Cash Flow

The last payment received from an investment, including the return of principal plus any final interest or dividend payments.

Inventory

The items and substances that a company possesses with the ultimate aim of selling them or using them in manufacturing.

Interest Expense

Interest expense is the cost incurred by an entity for borrowed funds, which can include interest on bonds, loans, convertible debt, and lines of credit.

Q23: Rights to purchase common stock at a

Q24: The following data has been collected about

Q49: On January 1, Haymark Corporation leased a

Q58: Martinez owns an asset that cost $87,000

Q78: Explain the use of a spreadsheet in

Q136: An employee earned $128,500 working for an

Q149: The employer should record deductions from employee

Q158: Zephyr Company's salaried employees earn four weeks

Q162: For each of the following independent transactions

Q192: _ is a general term that refers