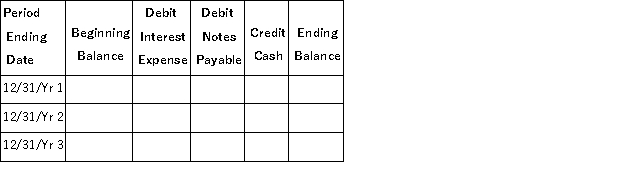

A company purchased two new delivery vans for a total of $250,000 on January 1, Year 1. The company paid $40,000 cash and signed a $210,000, 3-year, 8% note for the remaining balance. The note is to be paid in three annual end-of-year payments of $81,487 each, with the first payment on December 31, Year 1. Each payment includes interest on the unpaid balance plus principal.

(1) Prepare a note amortization table using the format below:  (2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

(2) Prepare the journal entries to record the purchase of the vans on January 1, Year 1 and the second annual installment payment on December 31, Year 2.

Definitions:

Guinness Book

A reference book published annually, listing world records both of human achievements and the extremes of the natural world.

Tertiary

Refers to the third level or stage in a sequence; in education, it commonly relates to post-secondary education such as universities and colleges.

Quaternary

Relating to the fourth stage or division, often used in context of geological periods or the sector of the economy that deals with knowledge-based activities.

Historiography

The study of the methods and principles through which history is written, including the different perspectives and interpretations.

Q9: The reporting of investing and financing activities

Q13: Phoenix Agency leases office space for $7,000

Q22: Druffle Industries issues 5,000 shares of $100

Q59: Common shareholders always share equally with all

Q60: On January 1, Year 1 Cleaver Company

Q109: A short-term note payable:<br>A)Is a written promise

Q126: On January 10, Mood Corporation purchased 15,000

Q178: Amortizing a bond discount:<br>A)Allocates a portion of

Q208: General Co. entered into the following transactions

Q215: Describe the recording procedures for the issuance,