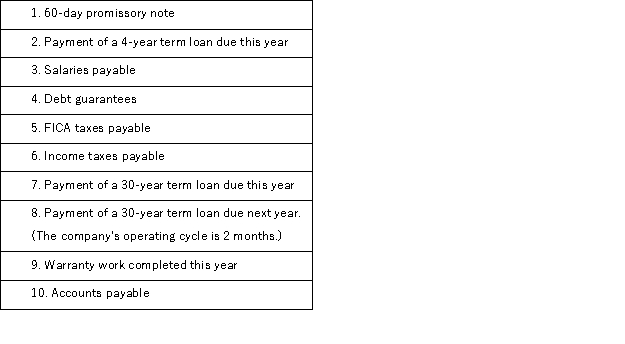

Classify each of the following items as either:

A.Current liability

B.Long-term liability

C.Not a liability

Definitions:

Income Tax Expense

The total amount of income tax a company is obligated to pay to the government, reported as an expense in the income statement.

Income Tax Rate

The percentage at which an individual or corporation is taxed on their income, which can vary based on income level, jurisdiction, and other factors.

After-Tax Discount Rate

A discount rate that has been adjusted for the effect of taxes, utilized in evaluating the net present value (NPV) of an investment after taxes.

Straight-Line Depreciation

A method of calculating the depreciation of an asset where its cost is evenly spread across its useful life.

Q19: All of the following are true of

Q29: Gary Marks is paid on a monthly

Q78: During the current year, a company exchanged

Q80: A company allows its customers to use

Q112: _ leases are short-term or cancelable leases

Q134: A company issued 10-year, 9% bonds with

Q136: An employee earned $128,500 working for an

Q152: A company had average total assets of

Q157: The quality of receivables refers to:<br>A)The creditworthiness

Q217: Fortune Drilling Company acquires a mineral deposit