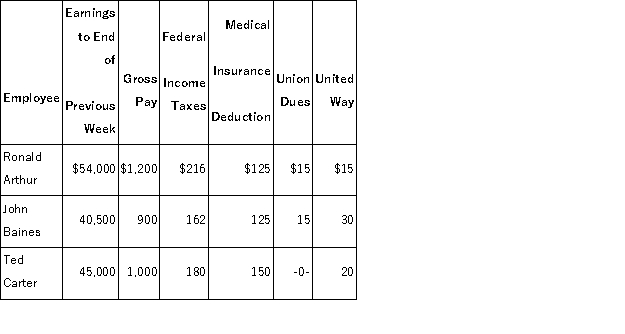

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Definitions:

Soda Tastes

The perceived flavors and sensory experience derived from consuming soda or carbonated soft drinks.

Edgar Cayce

An American self-proclaimed clairvoyant known for his psychic readings and contributions to alternative medicine.

Atlantis

A mythical island nation often described as having sunk into the ocean in ancient times.

Predicted

Forecasted or estimated the outcome or occurrence of something in the future based on current evidence or trends.

Q6: If the credit balance of the Allowance

Q29: Describe how accounts receivable arise and how

Q38: Freedom Air collected $165,000 in February for

Q60: On November 1, Casey's Snowboards signed a

Q104: What is a short-term note payable? Explain

Q142: On December 31, of the current year,

Q148: The _ method uses both past and

Q182: Johanna Corporation issued $3,000,000 of 8%, 20-year

Q185: Collateral from unsecured loans may be sold

Q230: The depreciation method that produces larger depreciation