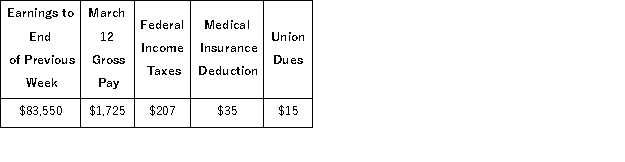

The payroll record of a company provided the following data for the current weekly pay period ended March 12 for employee R. Gold.  The Social Security portion of the FICA taxes is 6.2% on the first $118,500 per calendar year and the Medicare portion is 1.45% of all wages paid. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for R. Gold.

The Social Security portion of the FICA taxes is 6.2% on the first $118,500 per calendar year and the Medicare portion is 1.45% of all wages paid. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for R. Gold.

Definitions:

Stylized Interchange

A type of interaction that follows a predetermined pattern or set of social conventions, often found in rituals or formal communications.

Game

A structured form of play, usually undertaken for enjoyment and sometimes used as an educational tool.

Intimacy

The feeling of being close and emotionally connected and supported in a relationship, including physical, emotional, intellectual, and spiritual aspects.

Transactional Analysis

A psychotherapeutic approach that views interactions between individuals as transactions and uses these to understand and improve communication and behavior.

Q42: On May 22, Jarrett Company borrows $7,500

Q47: The current FUTA tax rate is 0.6%,

Q60: On November 1, Casey's Snowboards signed a

Q75: On April 12, Hong Company agrees to

Q76: White Company allows customers to make purchases

Q87: Giorgio Italian Market bought $4,000 worth of

Q192: _ is a general term that refers

Q198: Owens Company uses the direct write-off method

Q226: Explain in detail how to compute each

Q231: The calculation of total asset turnover is:<br>A)Gross