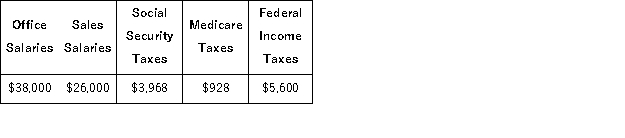

Deacon Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May.  a. Record the May payroll using the payroll register information given above.

a. Record the May payroll using the payroll register information given above.

b. Record the employer's payroll taxes resulting from the May payroll. The company had a state unemployment tax rate of 3.5% of the first $7,000 paid each employee. Only $42,000 of the current months salaries are subject to unemployment taxes. The federal rate is 0.6%.

c. Issue a check to Reliant Bank in payment of the May FICA and employee taxes.

d. Issue a check to the state for the payment of the SUTA taxes for the month of May.

e. Issue a check to Reliant Bank for the first quarter in FUTA taxes in the amount of $1,020.

Definitions:

Preferred Stock

A class of ownership in a corporation that has a higher claim on assets and earnings than common stock, usually with fixed dividends.

Par Value

The nominal or face value of a bond, share of stock, or other financial instrument, as stated by the issuer.

EPS Growth Rate

Refers to the rate at which a company's earnings per share (EPS) has grown over a specific period, usually annually, indicating the company's profitability growth.

Rate of Return

The increase or decrease in the value of an investment throughout a certain period, represented as a fraction of the original investment's price.

Q13: On January 1, $300,000 of par value

Q21: The direct write-off method of accounting for

Q42: On May 22, Jarrett Company borrows $7,500

Q76: Minor Company installs a machine in its

Q79: An asset that was originally purchased for

Q85: A company purchased a tract of land

Q174: A high value for the times interest

Q187: A company may retire bonds by all

Q217: Fortune Drilling Company acquires a mineral deposit

Q229: Lafferty Corporation reported earnings per share of