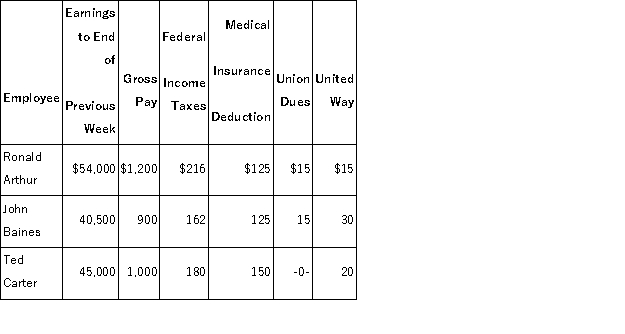

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA social security tax rate is 6.2% on the first $118,500 of earnings each calendar year and the FICA Medicare tax rate is 1.45% on all earnings. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Definitions:

Right from wrong

The moral ability or capacity to distinguish ethical actions from unethical ones.

Self-efficacy

An individual's belief in their own ability to complete tasks and achieve goals.

Cognitive appraisal

The process of interpreting and evaluating an event or situation that leads to an emotional response.

Relaxation

A state of reduced tension, stress, and mental and physical calm.

Q1: Employers must keep individual earnings reports for

Q21: The direct write-off method of accounting for

Q67: Granite Company purchased a machine costing $120,000,

Q86: On January 1, Duncan Corporation leased a

Q96: Jones Cement Company has an Accounts Receivable

Q151: Intangible assets do not include:<br>A)Patents.<br>B)Copyrights.<br>C)Trademarks.<br>D)Goodwill.<br>E)Land held as

Q153: _ refers to a plant asset that

Q168: A discount on bonds payable occurs when

Q199: Wickland Company installs a manufacturing machine in

Q224: Obligations to be paid within one year