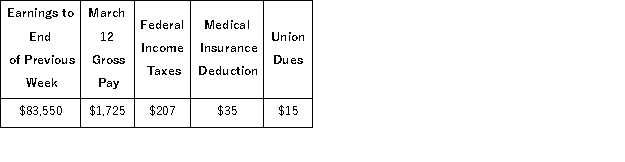

The payroll record of a company provided the following data for the current weekly pay period ended March 12 for employee R. Gold.  The Social Security portion of the FICA taxes is 6.2% on the first $118,500 per calendar year and the Medicare portion is 1.45% of all wages paid. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for R. Gold.

The Social Security portion of the FICA taxes is 6.2% on the first $118,500 per calendar year and the Medicare portion is 1.45% of all wages paid. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Calculate the net pay for R. Gold.

Definitions:

Quantity Demanded

The total amount of a good or service that consumers are willing and able to purchase at a given price.

Marginal Revenue

The additional income generated from selling one more unit of a good or service. It is a vital concept in determining the optimal level of output for a company.

Marginal Cost

Marginal Cost refers to the increase in total production cost that arises from producing one additional unit of a good or service.

Economic Profits

The surplus achieved when the revenue from business activities exceeds both the explicit and implicit costs, differing from accounting profits by considering opportunity costs.

Q4: The accounts receivable method to estimate bad

Q35: A company was organized in January 2016

Q66: The going concern assumption supports the reporting

Q73: Which of the following would be classified

Q84: Jasper makes a $25,000, 90-day, 7% cash

Q91: A company had net sales of $230,000

Q102: A company purchased a weaving machine for

Q102: On January 1, a company issued 10%,

Q186: Mercy Hospital issued $1,000,000 of 5% 20-year

Q241: Bering Rock acquires a granite quarry at