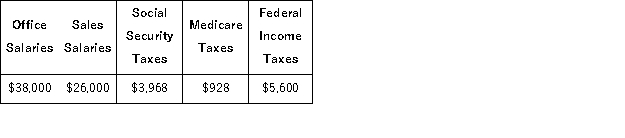

Deacon Company provides you with following information related to payroll transactions for the month of May. Prepare journal entries to record the transactions for May.  a. Record the May payroll using the payroll register information given above.

a. Record the May payroll using the payroll register information given above.

b. Record the employer's payroll taxes resulting from the May payroll. The company had a state unemployment tax rate of 3.5% of the first $7,000 paid each employee. Only $42,000 of the current months salaries are subject to unemployment taxes. The federal rate is 0.6%.

c. Issue a check to Reliant Bank in payment of the May FICA and employee taxes.

d. Issue a check to the state for the payment of the SUTA taxes for the month of May.

e. Issue a check to Reliant Bank for the first quarter in FUTA taxes in the amount of $1,020.

Definitions:

Inter Vivos Gift

A gift given by a living person during their lifetime, as opposed to a bequest or legacy left in a will, which does not take effect until after the donor's death.

Constructively Presented

A concept where something is deemed to be presented or made available through implication or through the circumstances, rather than by direct presentation.

Donative Intent

The intention to give a gift expressed by a donor, a key requirement in the law of gifts to demonstrate that a transfer is indeed intended as a gift.

Legal Action

Legal action is the process of seeking resolution or enforcement of rights through the judicial system.

Q23: A company's income before interest expense and

Q30: Peavey Enterprises purchased a depreciable asset for

Q49: Athena Company's salaried employees earn two weeks

Q53: On January 1, a company issued a

Q66: Floral Depot's income before interest expense and

Q95: A company had net sales of $1,540,500

Q118: Mercks accepts the Discovery credit card for

Q120: A company's employer payroll tax rates are

Q140: A company previously issued $2,000,000, 10% bonds,

Q216: When a company is obligated for sales