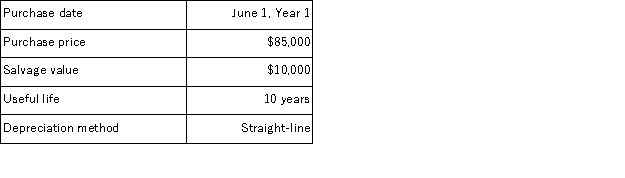

The following information is available on a depreciable asset owned by Mutual Savings Bank:  The asset's book value is $70,000 on June 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

The asset's book value is $70,000 on June 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last six months of Year 3 would be:

Definitions:

Short-Form Merger

A process where a parent company merges with a subsidiary company without needing the approval of the subsidiary's shareholders.

Appraisal Rights

The rights of a corporation's minority shareholders to have a judicial assessment of the fairness of a proposed transaction, typically a merger or acquisition.

Parent's Minority Shareholders

Individuals or entities that hold a smaller, non-controlling percentage of shares in the parent company.

Going Private Transaction

A process in which a publicly traded company is transformed into a privately held entity, usually by a buyout.

Q20: Cash equivalents:<br>A)Include savings accounts.<br>B)Include checking accounts.<br>C)Are readily

Q61: Identify the balance sheet classification of each

Q63: The rate that a state assigns reflecting

Q69: The matching principle requires that accrued interest

Q90: A company issued 10-year, 7% bonds with

Q91: Carson Company faces a probable loss on

Q108: Depreciation:<br>A)Measures the decline in market value of

Q140: The Branson Company uses the percent of

Q150: Early Co. offers its employees a bonus

Q207: A bond is issued at par value