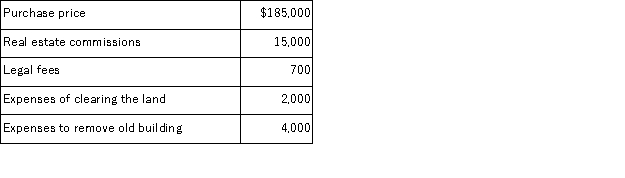

Merchant Company purchased property for a building site. The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

Definitions:

Intra-entity Gain

A profit recognized from transactions conducted within the same legal entity, often eliminated during consolidation for financial reporting.

Excess Annual Amortization

The amount by which the yearly amortization expense exceeds the norm or expected rate, often resulting from an aggressive write-down of intangible assets.

Accrual-based Net Income

Net income calculated using the accrual method of accounting, recognizing revenues when earned and expenses when incurred, regardless of when cash transactions occur.

Excess Annual Amortization

Excess annual amortization refers to the amount of amortization expense that exceeds the expected or standard amount within a given year, often related to intangible assets.

Q14: Wickland Company installs a manufacturing machine in

Q21: The direct write-off method of accounting for

Q24: Ordinary repairs meet all of the following

Q59: Deposits in transit are deposits made and

Q128: Jones Pharmacy agreed to pay $2,000 monthly

Q142: If a company has advance subscription sales

Q148: Effective cash management includes making efforts to

Q149: When using the allowance method of accounting

Q171: After preparing a bank reconciliation, adjustments must

Q176: Compare the different depreciation methods (straight-line, units-of-production,