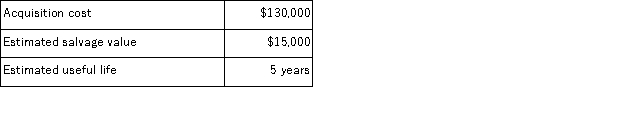

On April 1, Year 1, Astor Corp. purchased and placed a plant asset in service. The following information is available regarding the plant asset:  Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the straight-line depreciation method.

Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the straight-line depreciation method.

Definitions:

Opportunity Cost

The expense related to overlooking the next in line preferable option in the course of decision-making.

Opportunity Cost

The cost of forgoing the next best alternative when making a decision, effectively representing the benefits you miss out on choosing one option over another.

Inefficient Outcome

A result or situation in which resources are not utilized in the best possible manner, leading to potential wastage or loss.

Production Possibilities Frontier

A curve depicting all maximum output possibilities for two or more goods, given a set of inputs, representing the trade-off between different choices.

Q17: A company received a $15,000, 90-day, 10%

Q18: Loong Industries collected $17,350 of sales tax

Q60: Credit sales are recorded by crediting an

Q103: Equipment with a cost of $103,000 and

Q123: A company purchased and installed equipment on

Q134: A potential lawsuit claim is disclosed when

Q149: A company purchased and installed equipment on

Q151: Times interest earned is computed by dividing

Q183: Accrued vacation benefits are a form of

Q248: A plant asset's useful life is the