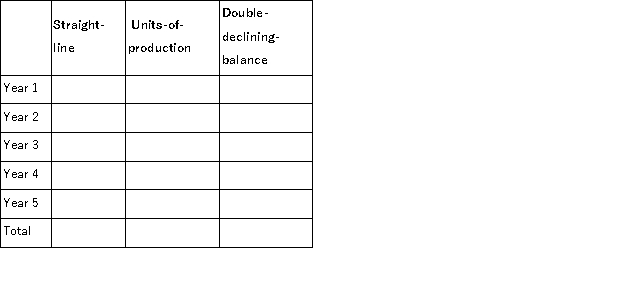

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a salvage value of $75,000) using each of the below-mentioned methods. During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Income Taxes

Taxes levied by the government on the income generated by businesses and individuals, which vary by income levels and jurisdictions.

Ending Inventory

The total value of goods available for sale at the end of an accounting period, calculated by adding new purchases to the starting inventory and subtracting goods sold.

Inventory Valuation Methods

Techniques used to calculate the cost of goods sold and ending inventory, such as FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and average cost methods.

Gross Profit Method

An accounting technique used to estimate the amount of ending inventory and cost of goods sold, based on the gross profit margin.

Q6: The cost of an inventory item includes

Q9: What is the maturity date of a

Q13: Meng Co. establishes a $250 petty cash

Q64: On September 1, Knack Company signed a

Q76: Contingent liabilities are recorded or disclosed unless

Q81: _ is an estimate of an asset's

Q105: Principles of internal control include all of

Q127: A company's income before interest expense and

Q135: The days' sales in inventory ratio is

Q180: The formula for computing interest on a