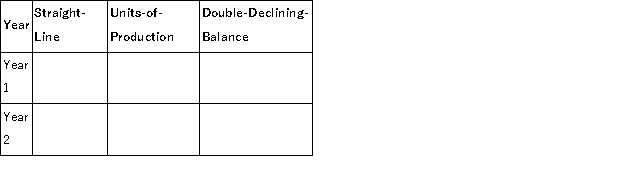

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1. The company estimates the machine will produce 1,050,000 units of product during its life. It actually produces the following units for the first 2 years: Year 1, 260,000; Year 2, 275,000. Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method. Show calculation of amounts below the table.

Definitions:

Function Declaration

The part of a program that specifies the name, return type, and parameters of a function without defining what it does.

Address

A numeric representation of a location in memory where data is stored, often used in programming for accessing and manipulating data directly.

Two-dimensional Array

A two-dimensional array is an array of arrays, allowing for storage of data in a matrix-like structure where elements are accessed using two indexes.

Element

An individual item or component in a data structure, such as an array or list, which can be accessed or manipulated programmatically.

Q4: Contingent liabilities are recorded in the accounts

Q20: Cash equivalents:<br>A)Include savings accounts.<br>B)Include checking accounts.<br>C)Are readily

Q54: The following information is available for Birch

Q59: A company purchased property for $100,000. The

Q84: A company's payroll for the week ended

Q113: The treasurer of a company is responsible

Q116: Giorgio Italian Market bought $4,000 worth of

Q133: The following data are taken from the

Q140: The Branson Company uses the percent of

Q167: Sales taxes payable is debited and cash