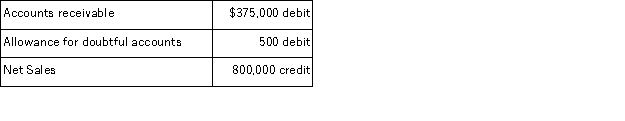

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates that 0.6% of credit sales are uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

All sales are made on credit. Based on past experience, the company estimates that 0.6% of credit sales are uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared?

Definitions:

Excess Amortization Expenses

Costs that are higher than expected for the amortization of intangible assets, sometimes indicating an overly aggressive depreciation of these assets.

Fiscal Year

A one-year period used for accounting purposes and preparing financial statements, which may not coincide with the calendar year.

Post-Acquisition Period

The time frame after an acquisition has been completed, focusing on the integration and performance analysis of the acquired entity.

Mid-Year Acquisition

The purchase of another business or significant assets during the middle of the fiscal year, affecting financial statements and operations.

Q32: Given the following information, determine the cost

Q39: The annual Federal Unemployment Tax Return is:<br>A)Form

Q55: An employee earns $5,500 per month working

Q60: At the end of the current period,

Q68: On June 30 a company needed to

Q86: Marlow Company purchased a point of sale

Q103: Equipment with a cost of $103,000 and

Q149: When using the allowance method of accounting

Q156: The wage bracket withholding table is used

Q168: A finance company or bank that purchases