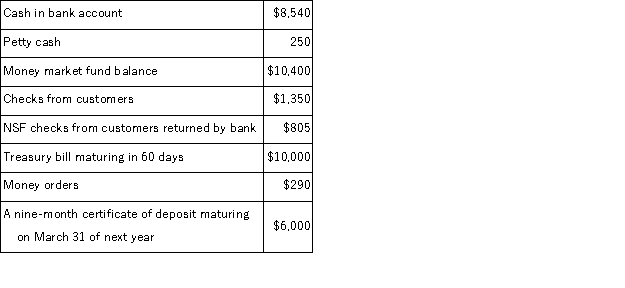

The following information is available for Montrose Company at December 31:  Based on this information, the amounts considered Cash and Cash Equivalents, respectively on December 31 are:

Based on this information, the amounts considered Cash and Cash Equivalents, respectively on December 31 are:

Definitions:

NCI

Non-controlling interest, a portion of the equity in a subsidiary not attributable directly or indirectly to the parent company.

Profit

The financial gain realized when the revenues generated from business activities exceed the expenses, taxes, and costs associated with maintaining the business.

Inter-Entity Transactions

Transactions that occur between two entities within the same parent company or corporate group, affecting the accounting practices and consolidation processes of the group.

NCI

An acronym for Non-Controlling Interest, representing minority ownership in an enterprise, where the owner does not have significant control over the company’s operations.

Q48: Juniper Company, Inc. uses the gross method

Q54: The _ is a measure of how

Q72: The Barron Company uses the percent of

Q141: A service company earns net income by

Q156: A company had the following purchases during

Q188: Reporting the details of notes is consistent

Q191: Marks Consulting purchased equipment costing $45,000 on

Q193: Discuss how the principles of internal control

Q194: The cost of an inventory item includes

Q225: A company exchanged an old automobile for