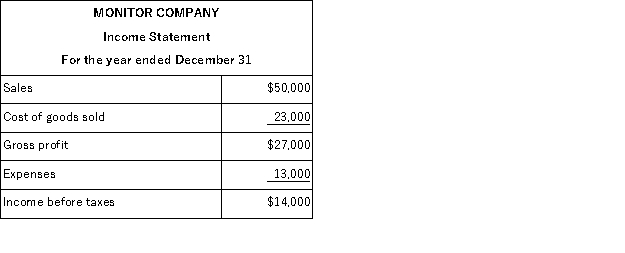

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for their first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had they used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had they used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

Definitions:

Dotted Decimal

A representation of IP addresses wherein four sets of numbers separated by dots indicate the unique address.

Ip Address

Internet Protocol Address, a unique string of numbers separated by periods that identifies each computer using the IP to communicate over a network.

Department of Defense

A federal agency responsible for coordinating and supervising all agencies and functions of the government directly related to national security and the United States armed forces.

Web Browser

A software application for accessing information on the World Wide Web, rendering web pages, and navigating between them.

Q14: Jervis accepts all major bank credit cards,

Q36: Which inventory valuation method assigns a value

Q43: Adjusting entries are made after the preparation

Q46: The matching principle requires that the inventory

Q53: The _ inventory system continually updates accounting

Q89: When purchase costs regularly rise, the _

Q92: Bonita Company estimates uncollectible accounts using the

Q97: The Petty Cash account is a separate

Q147: When LIFO is used with the periodic

Q212: In a period of rising prices, FIFO