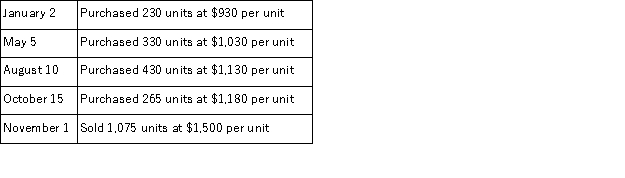

A merchandiser that uses a periodic inventory system made the following cash purchases and sales during the year. There was no beginning inventory.  The company has a calendar year-end and uses the FIFO inventory valuation method. Calculate the ending inventory balance and cost of goods sold for the year.

The company has a calendar year-end and uses the FIFO inventory valuation method. Calculate the ending inventory balance and cost of goods sold for the year.

Definitions:

MIRR

Modified Internal Rate of Return, a financial measure used to evaluate the attractiveness of investments, taking into account the cost of capital and the reinvestment rate.

Cost of Capital

A minimum profit rate a business has to achieve on its ventures to sustain its market price and appeal to investors.

MIRR

Modified Internal Rate of Return, a financial measure used to evaluate the profitability of investments, adjusting for differences in cash flow timing and reinvestment rates.

Cost of Capital

The rate of return that a company needs to earn on its investment projects to maintain its market value and satisfy its investors and creditors.

Q5: Frederick Company borrows $63,000 from First City

Q15: On November 19, Nicholson Company receives a

Q38: Acme-Jones Corporation uses a weighted average perpetual

Q49: Before an adjusting entry to recognize the

Q66: A company's fiscal year must correspond with

Q83: On July 9, Mifflin Company receives a

Q130: Cash and office supplies are both classified

Q154: A remittance advice is a(n):<br>A)Explanation for a

Q218: Explain the difference between the retail inventory

Q224: On October 15, a company received $15,000