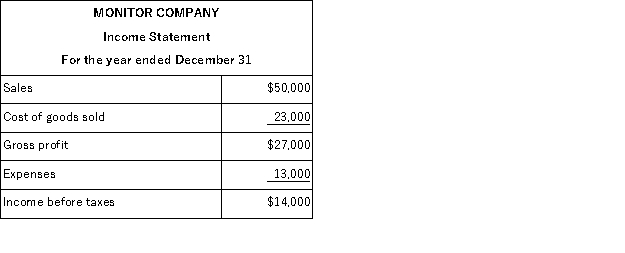

Monitor Company uses the LIFO method for valuing its ending inventory. The following financial statement information is available for their first year of operation:  Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had they used FIFO, the ending inventory would have been $8,500.

Monitor's ending inventory using the LIFO method was $8,200. Monitor's accountant determined that had they used FIFO, the ending inventory would have been $8,500.

a. Determine what the income before taxes would have been had Monitor used the FIFO method of inventory valuation instead of LIFO.

b. What would be the difference in income taxes between LIFO and FIFO, assuming a 30% tax rate?

Definitions:

Fiber-optic

Relating to or using thin flexible fibers of glass or other transparent solids to transmit light signals for telecommunications or computing.

Ethernet Cables

Wired technology used to network devices, allowing for data transmission over local area networks.

Sample

A subset of individuals or observations drawn from a larger population, used in statistical analysis to estimate characteristics of the entire population.

Subscription Service

A business model where customers pay a recurring price at regular intervals for access to a product or service.

Q2: A company uses the retail inventory method

Q48: Juniper Company, Inc. uses the gross method

Q67: A retailer is an intermediary that buys

Q92: In order to streamline the purchasing process,

Q134: Which of the following is not true

Q152: Describe the difference(s) between accounting for sales

Q155: Explain the options a company may use

Q194: A company's December 31 work sheet for

Q213: To avoid the time-consuming process of taking

Q255: Juniper Company, Inc. uses the gross method