Based on the unadjusted trial balance for Highlight Styling, Inc. and the adjusting information given below, prepare the adjusting journal entries for Highlight Styling Inc.

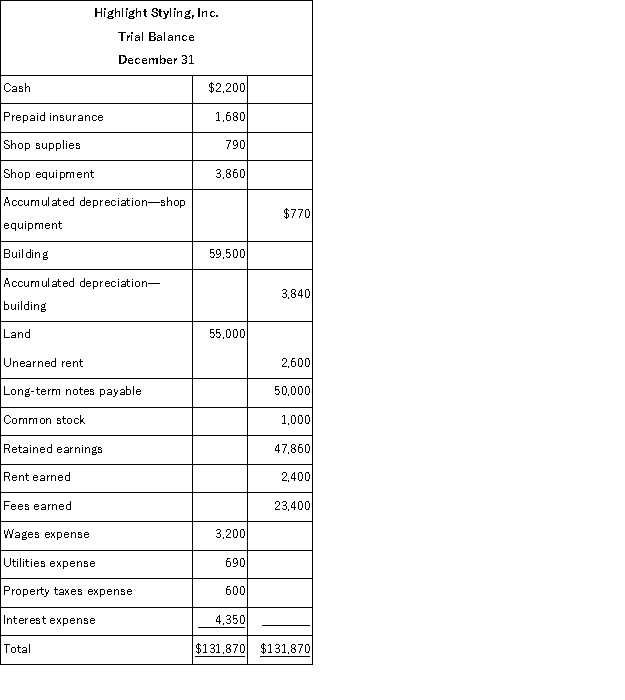

Highlight Styling Inc.'s unadjusted trial balance for the current year follows:  Additional information:

Additional information:

a. An insurance policy examination showed $1,040 of expired insurance.

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,020.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was still unearned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded.

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Definitions:

All-Or-Nothing Thinking

A cognitive distortion involving seeing situations in only two categories instead of on a continuum, such as completely right or completely wrong with no middle ground.

Overgeneralization

A cognitive distortion where an individual applies a general rule too broadly, based on a single incident.

Jumping To Conclusions

A cognitive distortion where an individual makes a premature, often negative, interpretation without sufficient evidence.

Humanistic Approaches

A psychological perspective that emphasizes the study of the whole person and the uniqueness of each individual's experience.

Q24: Reductions in the selling price of defective

Q67: Determine the net income of a company

Q78: A multiple-step income statement format shows detailed

Q98: On September 12, Vander Company, Inc. sold

Q121: _ expenses are those costs that support

Q121: U.S. Government Treasury bonds provide low return

Q129: The third step in the analyzing and

Q177: Which of the following accounts showing a

Q215: Under both the periodic and perpetual inventory

Q248: Match each of the following items 1