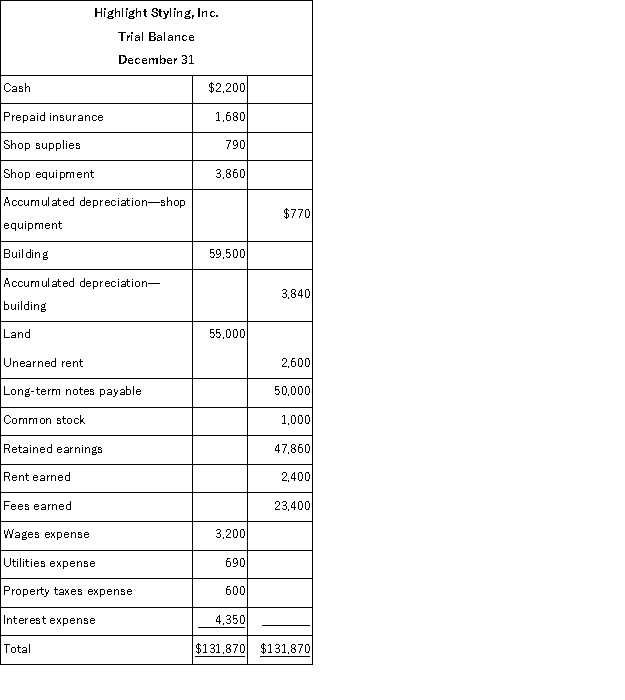

Based on the unadjusted trial balance for Highlight Styling, Inc. and the adjusting information given below, prepare the adjusting journal entries for Highlight Styling Inc.

Highlight Styling Inc.'s unadjusted trial balance for the current year follows:  Additional information:

Additional information:

a. An insurance policy examination showed $1,040 of expired insurance.

b. An inventory count showed $210 of unused shop supplies still available.

c. Depreciation expense on shop equipment, $350.

d. Depreciation expense on the building, $2,020.

e. A beautician is behind on space rental payments, and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f. $800 of the Unearned Rent account balance was still unearned by year-end.

g. The one employee, a receptionist, works a five-day workweek at $50 per day. The employee was paid last week but has worked four days this week for which she has not been paid.

h. Three months' property taxes, totaling $450, have accrued. This additional amount of property taxes expense has not been recorded.

i. One month's interest on the note payable, $600, has accrued but is unrecorded.

Definitions:

Process Inventory

Goods in various stages of production within a company, excluding raw materials and finished products.

Process Costing

An accounting methodology used for homogeneous product costing, where costs are accumulated over a period and then allocated to a large number of identical units.

Equivalent Units

A concept in cost accounting used to allocate costs evenly in processes where incomplete units complicate direct measurement.

Assembly Department

A specialized department within a manufacturing facility where components are assembled into final products.

Q57: Define Merchandise Inventory and describe the types

Q129: Under the alternative method for recording prepaid

Q134: A partially completed work sheet is shown

Q158: Identifying _ and _ is the starting

Q185: A record containing all the separate accounts

Q190: Beginning inventory plus net purchases equals:<br>A)Cost of

Q210: If a company plans to continue business

Q222: Which of the following accounts would be

Q235: Use the following information as of December

Q236: The current liability account credited when recording