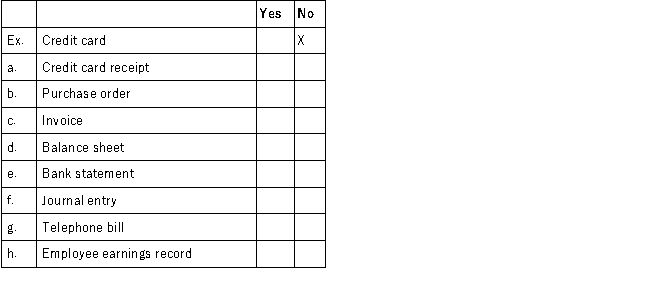

Identify by marking an X in the appropriate column, whether each of the following items would likely serve as a source document. The first one is done as an example:

Definitions:

Adjustment Columns

Special columns found in accounting ledgers and worksheets used for making necessary modifications to accounts at the end of a reporting period.

Depreciation Expense

The cost allocated over the useful life of a tangible asset to account for its decline in value due to use and time.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since the asset was acquired and available for use.

Adjusting Entry

A journal entry made at the end of an accounting period to update account balances to reflect accurate and fair financial statements.

Q7: Reno contributed $104,000 in cash plus equipment

Q40: Explain the steps involved in the liquidation

Q71: Profit margin reflects the percent of profit

Q108: Prevor Corporation reports the following account balances

Q122: Assets created by selling goods and services

Q126: Indicate on which of the financial statements

Q169: Owner financing refers to resources contributed by

Q180: Prepare general journal entries on December 31

Q187: The business paid $100 cash dividend to

Q202: Identify the account below that is classified