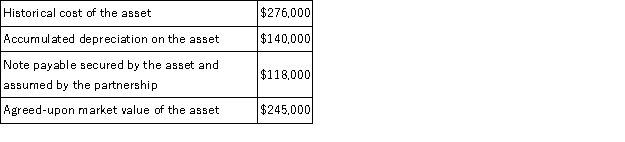

Dalworth and Minor have decided to form a partnership. Minor is going to contribute a depreciable asset to the partnership as her equity contribution to the partnership. The following information regarding the asset to be contributed by Minor is available:  Based on this information, Minor's beginning equity balance in the partnership will be:

Based on this information, Minor's beginning equity balance in the partnership will be:

Definitions:

IASB Requirements

The mandatory guidelines and standards set by the International Accounting Standards Board for financial reporting and accounting practices worldwide.

Cash-Generating Units

The smallest identifiable group of assets that generates cash inflows and is largely independent of the cash inflows from other assets or groups of assets.

Operating Segments

Components of a business from which separate financial information is available and are regularly reviewed by the enterprise’s decision-makers for performance assessment and resource allocation.

Consolidated Net Income

The total profit of a corporation and its subsidiaries after taxes, interest, depreciation, and other expenses have been deducted, reflecting the overall earnings of the conglomerate.

Q6: In Zamora v.Columbia Broadcasting System plaintiffs alleged

Q34: An example of an investing activity is:<br>A)Paying

Q66: Segmental Manufacturing owns 35% of Glesson Corp

Q70: Held-to-maturity securities are:<br>A)Always classified as Short-Term Investments.<br>B)Always

Q91: Identify the item below that would cause

Q112: Dalworth and Minor have decided to form

Q115: Doc's Ribhouse had beginning equity of $52,000;

Q120: Tower, Knight, and Spears are partners who

Q122: Assets created by selling goods and services

Q269: All of the following are classified as