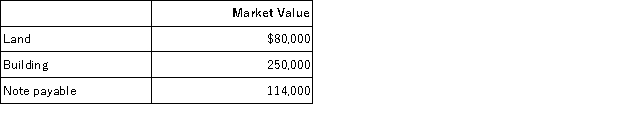

Caroline Meeks and Charlie Fox decide to form a partnership on August 1. Meeks invests the following assets and liabilities in the new partnership:  The note payable is associated with the building and the partnership will assume responsibility for the loan. Fox invested $100,000 in cash and $95,000 in equipment in the new partnership. Prepare the journal entries to record the two partners' original investments in the new partnership.

The note payable is associated with the building and the partnership will assume responsibility for the loan. Fox invested $100,000 in cash and $95,000 in equipment in the new partnership. Prepare the journal entries to record the two partners' original investments in the new partnership.

Definitions:

Church Doctrine

Official teachings and beliefs sanctioned by a religious institution, particularly within Christianity.

Possession

The state of having, owning, or controlling something, or in some contexts, a state in which a person is believed to be influenced or controlled by an external entity.

Nervous Breakdown

A non-medical term that signifies a period of intense mental distress, where an individual is unable to function normally in everyday life.

Mental Hygiene Movement

A movement started by Dorothea Dix (1802–1887), a Boston schoolteacher, characterized by a desire to protect and provide humane treatment for the mentally ill. Her campaign resulted directly in the opening of 32 state hospitals, including 2 in Canada. Despite the noble aims, the asylums were overcrowded and the staff had no time to do more than warehouse and restrain the patients.

Q3: Explain how transactions (both sales and purchases)

Q14: In Brandenburg v.Ohio the Supreme Court held

Q21: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q23: Sometimes consent to enter private property is

Q33: The area of accounting aimed at serving

Q35: Peters and Chong are partners and share

Q73: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q76: Partners in a partnership are taxed on

Q80: A company's operating and financing totals are

Q148: Smiles Entertainment had the following accounts and