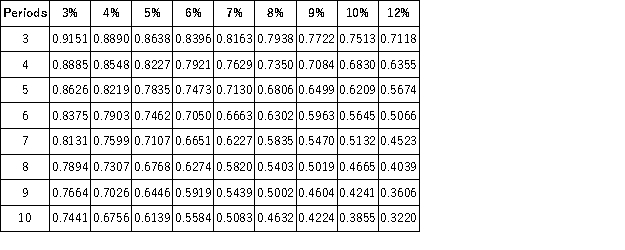

Present Value of 1  Future Value of 1

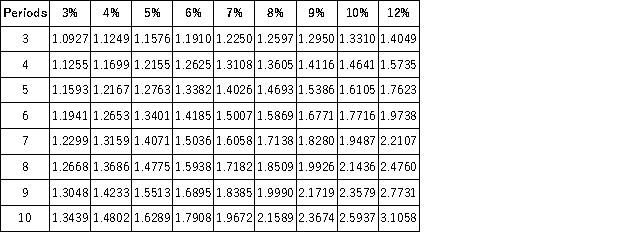

Future Value of 1  Present Value of an Annuity of 1

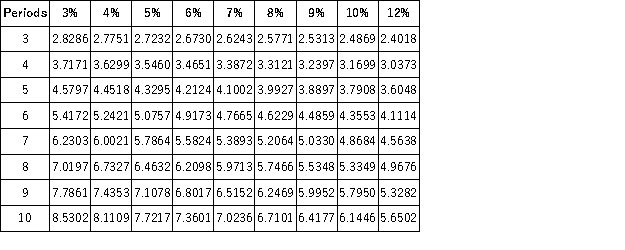

Present Value of an Annuity of 1  Future Value of an Annuity of 1

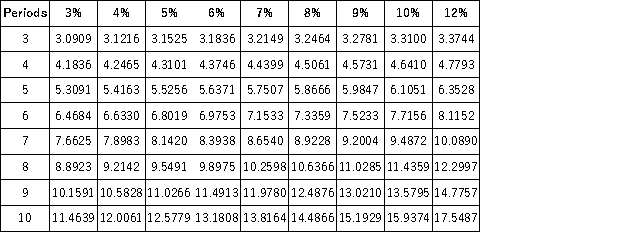

Future Value of an Annuity of 1  Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

Sandra has a savings account that has accumulated to $50,000. She started with $28,225, and earned interest at 10% compounded annually. It took her five years to accumulate the $50,000.

PV Factor = Present Value/Future Value

PV Factor = $28,225/$50,000 = 0.5645

0.5645 is the present value of 1 factor for 6 periods at 10%

Definitions:

Cervical

Relating to the cervix in the context of the female reproductive system or the neck region in the context of anatomy.

Lumbar

Referring to the lower part of the spine or lower back region, composed of five vertebrae between the thoracic vertebrae and the sacral region.

Diencephalon

The diencephalon is a region of the brain that includes structures such as the thalamus and hypothalamus, integral to the regulation of various physiological processes.

Brain Stem

The lower part of the brain that connects the cerebrum with the spinal cord and controls vital functions like breathing and heart rate.

Q3: The nurse is providing care to a

Q11: When there is no contested issue of

Q16: The case of Hugo Zacchini,the "human cannonball,"

Q18: In two recent Supreme Court cases,Wilson v.Layne

Q31: Fallon and Springer formed a partnership on

Q50: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q115: Cash equivalents are investments that are readily

Q144: Identify the risk and the return in

Q150: A company reported net income for Year

Q163: Fontaine and Monroe are forming a partnership.