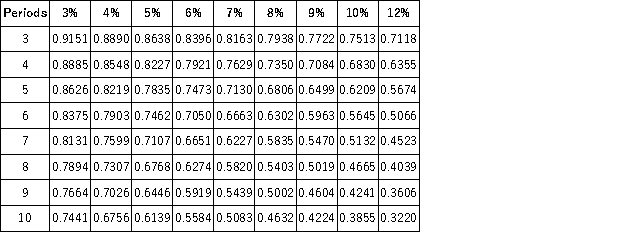

Present Value of 1  Future Value of 1

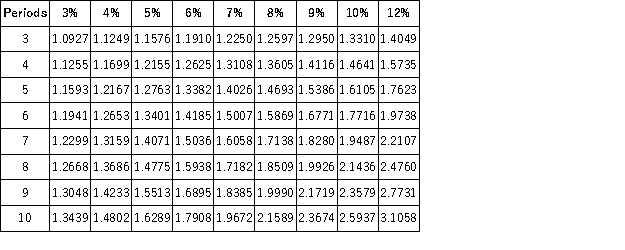

Future Value of 1  Present Value of an Annuity of 1

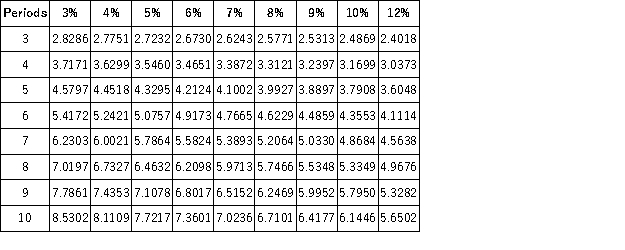

Present Value of an Annuity of 1  Future Value of an Annuity of 1

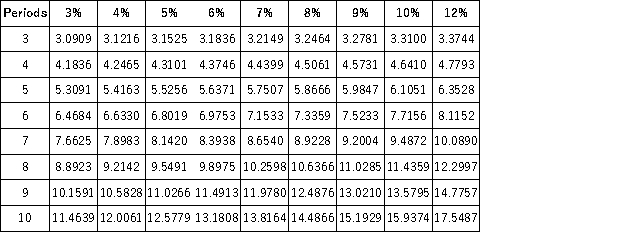

Future Value of an Annuity of 1  Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?

Keisha has $3,500 now and plans on investing it in a fund that will pay her 12% interest compounded quarterly. How much will Keisha have accumulated after 2 years?

Definitions:

Personality Psychologist

A psychologist who studies variations in behavior, thinking, and emotion among individuals, focusing on traits and patterns that differentiate one person from another.

Cognitive Psychologist

A specialist in psychology who studies mental processes such as perception, memory, thinking, problem-solving, and language.

Organizational Psychologist

A professional who applies psychological theories and principles to organizations, focusing on improving workplace productivity, and the mental health of employees.

Testable Prediction

A hypothesis or forecast that can be verified through experimentation or observation.

Q2: In New York Times v.Sullivan the plaintiff

Q5: A clientpatient is to receive 500 mL

Q10: The nurse is preparing to administer 0.25

Q20: The nurse needs prepares to irrigate a

Q26: Unless a libel plaintiff proves actual malice

Q32: Masco, Short, and Henderson who are partners

Q68: Cloverton Corporation had net income of $30,000,

Q108: On February 15, Jewel Company buys 7,000

Q114: Wright, Bell, and Edison are partners and

Q120: Charlie's Chocolates Inc.'s stockholders made investments of