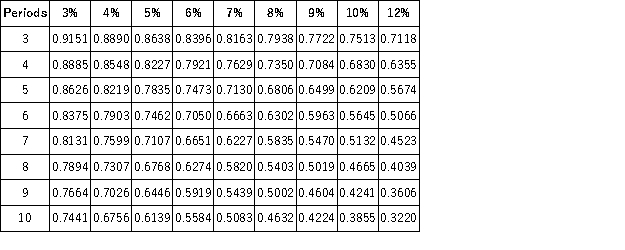

Present Value of 1  Future Value of 1

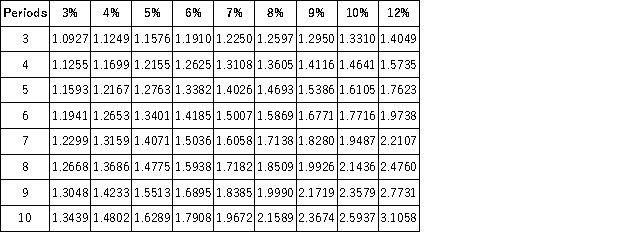

Future Value of 1  Present Value of an Annuity of 1

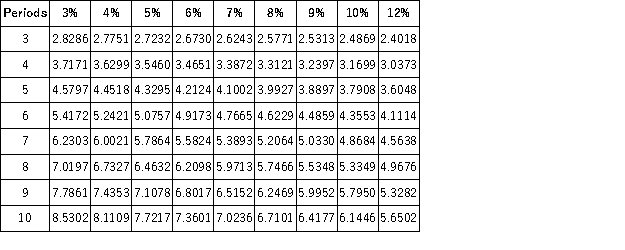

Present Value of an Annuity of 1  Future Value of an Annuity of 1

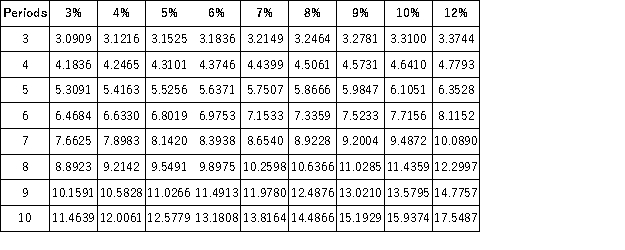

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded semiannually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

Definitions:

Dichotic Listening

A psychological test to study selective attention and the lateralization of brain function by presenting different sounds to each ear.

Cerebral Asymmetry

Refers to the morphological or functional differences between the two hemispheres of the brain, often influencing cognitive abilities and behaviors.

Brain Regions

Specific areas within the brain that are responsible for different functions, such as emotional regulation, sensory processing, and motor control.

Stimuli

External or internal changes that affect the senses and can elicit responses from an organism.

Q6: What are the accounting basics for debt

Q10: A client is prescribed 125 mg of

Q13: The Communications Act requires that broadcasters provide

Q14: The term jurisdiction refers to<br>A)the geographical territory

Q15: At the scenes of accidents,crimes,and natural disasters,newspeople

Q65: The life of a partnership is _

Q113: Canberry Corporation had net income of $80,000,

Q150: If a partner is unable to cover

Q199: On May 1 of the current year,

Q270: There are three major types of business