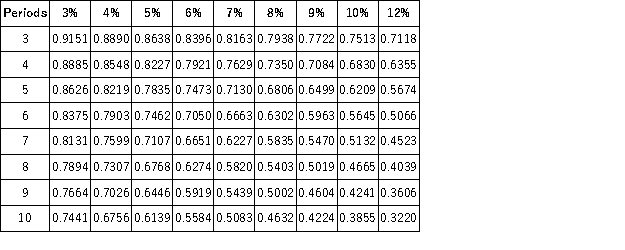

Present Value of 1  Future Value of 1

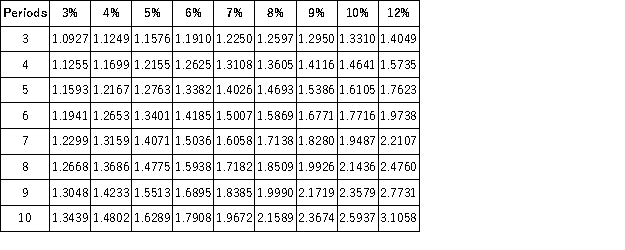

Future Value of 1  Present Value of an Annuity of 1

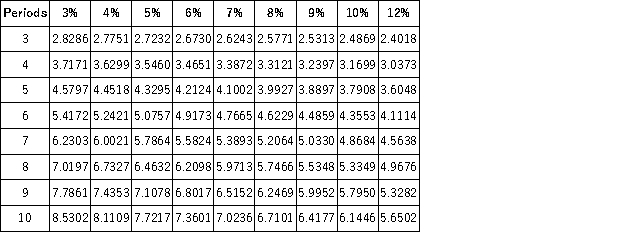

Present Value of an Annuity of 1  Future Value of an Annuity of 1

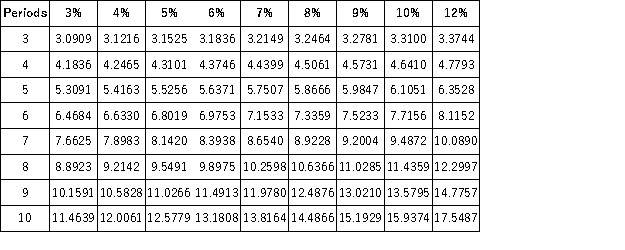

Future Value of an Annuity of 1  When you reach retirement age, you will have one fund of $100,000 from which you are going to make annual withdrawals of $14,702. The fund will earn 6% per year. For how many years will you be able to draw an even amount of $14,702?

When you reach retirement age, you will have one fund of $100,000 from which you are going to make annual withdrawals of $14,702. The fund will earn 6% per year. For how many years will you be able to draw an even amount of $14,702?

Definitions:

Bankruptcy Court

A federal court of limited jurisdiction that hears only bankruptcy proceedings.

Bankruptcy Law

Bankruptcy Law refers to regulations that govern the process by which individuals or entities unable to pay their debts can seek relief through a legal declaration of bankruptcy.

Proceedings

A series of actions or steps taken in order to achieve a particular legal outcome or to conduct official business.

Diversity Jurisdiction

Diversity jurisdiction is a form of subject-matter jurisdiction in U.S. federal courts that allows for lawsuits between parties from different states or countries.

Q2: A client is prescribed to take 15

Q3: In 2000 the federal Court of Appeals

Q9: A newborn weighs 120 ounces.How many lbs.should

Q11: Suppose a TV journalist officially declares his

Q15: Barber and Atkins are partners in an

Q19: The federal Trade Commission's basic authority is

Q26: Unless a libel plaintiff proves actual malice

Q52: Long-term investments in available-for-sale securities are reported

Q94: Lemon and Parks are partners. On October

Q253: A parcel of land is offered for