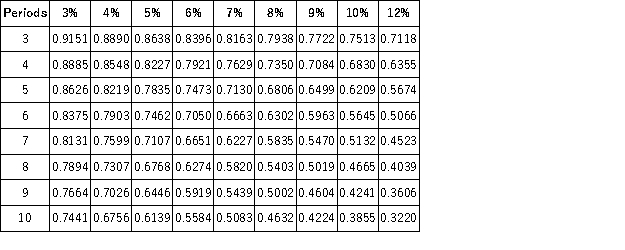

Present Value of 1  Future Value of 1

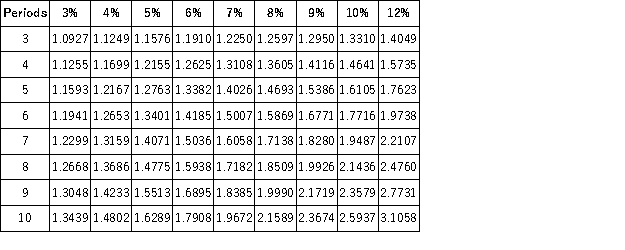

Future Value of 1  Present Value of an Annuity of 1

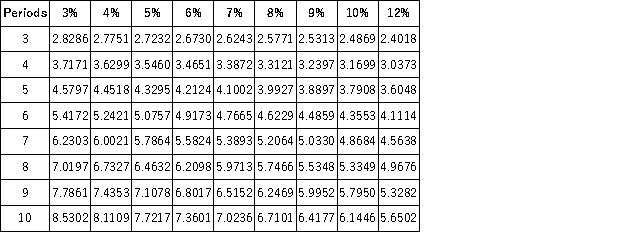

Present Value of an Annuity of 1  Future Value of an Annuity of 1

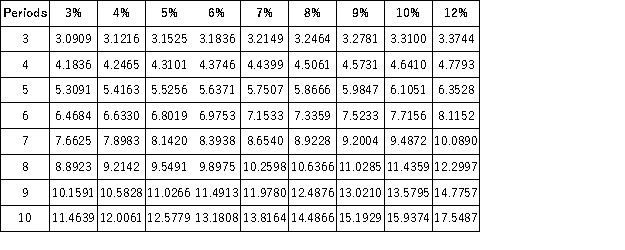

Future Value of an Annuity of 1  Milton Shirer has won the New York state lottery when the jackpot was $20 million. He has the options of taking the prize winnings as $2 million per year over the next ten years or a single payment now of $13,000,000. Which option should Milton choose based on present value principles and assuming an 8% annual interest rate compounded annually?

Milton Shirer has won the New York state lottery when the jackpot was $20 million. He has the options of taking the prize winnings as $2 million per year over the next ten years or a single payment now of $13,000,000. Which option should Milton choose based on present value principles and assuming an 8% annual interest rate compounded annually?

Definitions:

Precising Definition

A definition that seeks to make more precise what was previously vague or fuzzy.

Precise Measurements

The act of determining the exact size, quantity, or degree of something using specific tools and methods.

Flexibility

The quality of being adaptable or variable, especially in the face of change or new circumstances.

Language

The method of human communication, either spoken or written, consisting of the use of words in a structured and conventional way.

Q3: Simplify the complex equation 13/15 x 200

Q3: Explain how transactions (both sales and purchases)

Q3: In Sony Corp.v.Universal City Studios (the Betamax

Q5: The pediatric client is prescribed Dycill (dicloxacillin

Q5: In Cruz v.Ferre a federal Court of

Q13: By the mid-seventeenth century in England,what two

Q13: The case of Dietemann v.Time Inc.illustrates that<br>A)there

Q118: Sharon and Nancy formed a partnership by

Q131: Comprehensive income includes all except:<br>A)Revenues and expenses

Q154: On January 2, Froxel Company purchased 10,000