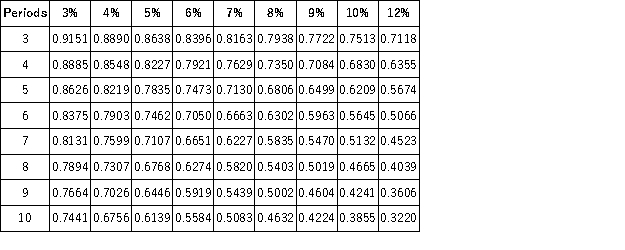

Present Value of 1  Future Value of 1

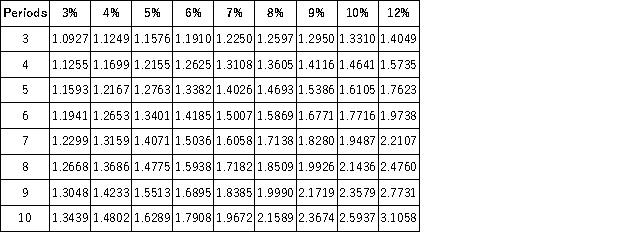

Future Value of 1  Present Value of an Annuity of 1

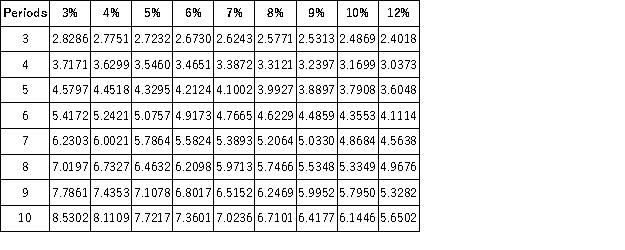

Present Value of an Annuity of 1  Future Value of an Annuity of 1

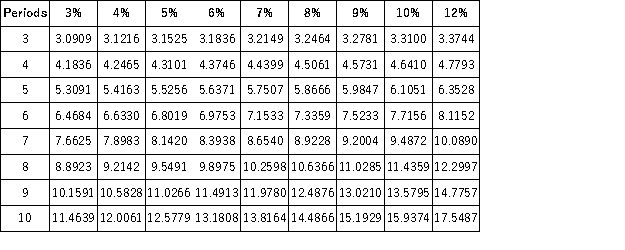

Future Value of an Annuity of 1  The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

The present value of $5,000 per year for three years at 12% compounded annually is $12,009.

2.4018 is the PV factor on the Present Value of an Annuity table; n = 3; i = 12%

Present Value of an Annuity = Annuity * PV Factor

Present Value of an Annuity = $5,000 * 2.4018 = $12,009

Definitions:

Net Fair Value

The amount that an asset could be bought or sold for in a current transaction between willing parties, minus any selling costs.

Unrecorded Goodwill

Goodwill that has arisen through operations but has not been formalized in the financial statements because it has not been acquired through a business combination.

Business Combination

The process of merging two or more entities into one, typically to achieve operational synergies or market expansion.

Useful Life

The period over which an asset is expected to be usable by an entity for its intended purpose.

Q7: Reno contributed $104,000 in cash plus equipment

Q9: If the Commission determines that a voluntary

Q17: The First Amendment was for the first

Q18: In Community for Creative Non-Violence v.Reid the

Q41: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q45: The following information is available on TGR

Q79: In the current year, Largo Co. purchased

Q94: Lemon and Parks are partners. On October

Q107: Unrealized gains and losses on trading securities

Q190: Kendall Corp. purchased at par value $75,000