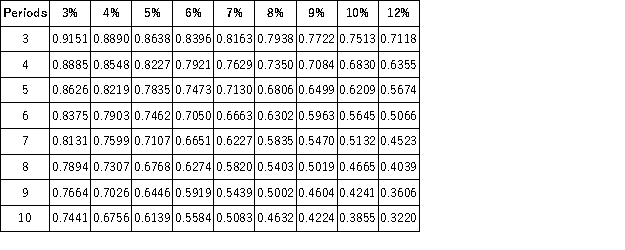

Present Value of 1  Future Value of 1

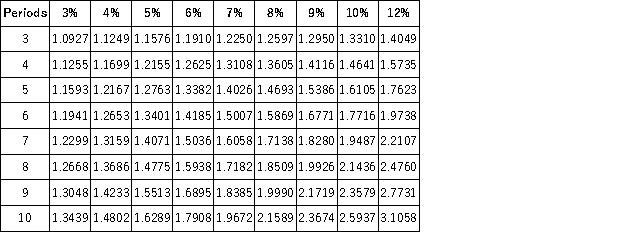

Future Value of 1  Present Value of an Annuity of 1

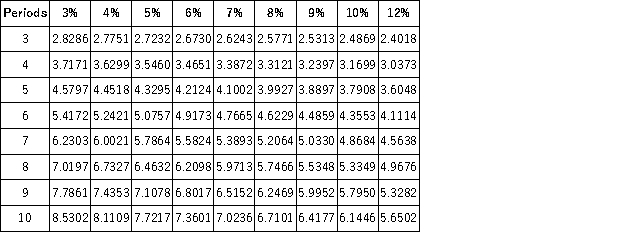

Present Value of an Annuity of 1  Future Value of an Annuity of 1

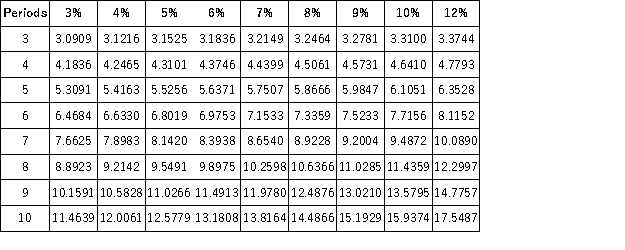

Future Value of an Annuity of 1  Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?

Russell Company has acquired a building with a loan that requires payments of $20,000 every six months for 5 years. The annual interest rate on the loan is 12%. What is the present value of the building?

Definitions:

Supply Chain Analytic Devices

Tools and systems used for extracting, analyzing, and interpreting data to improve decision-making throughout the supply chain.

Seven Principles

Often refers to foundational guidelines or core tenets that drive a methodology, strategy, or approach in various fields.

Differentiate Products

The strategy of making a product stand out from its competitors by emphasizing unique features or benefits.

Q6: Copyright law protects the creator's particular<br>A)manner of

Q8: A client is prescribed to receive ½

Q15: The U.S.Supreme Court has not directly decided

Q18: Which of the following best describes how

Q19: A client ingested ½ of 4 ounces

Q20: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q54: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q73: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q105: Montez and Flair formed a partnership. Montez

Q112: Dalworth and Minor have decided to form