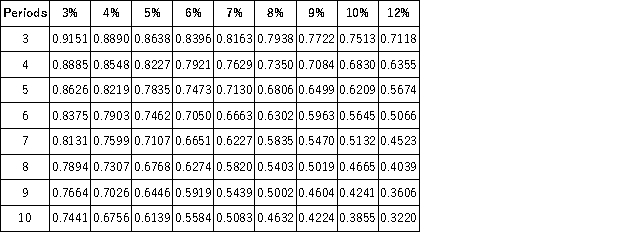

Present Value of 1  Future Value of 1

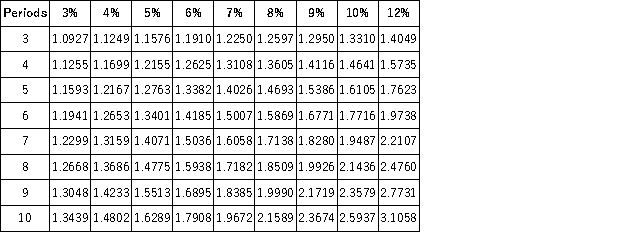

Future Value of 1  Present Value of an Annuity of 1

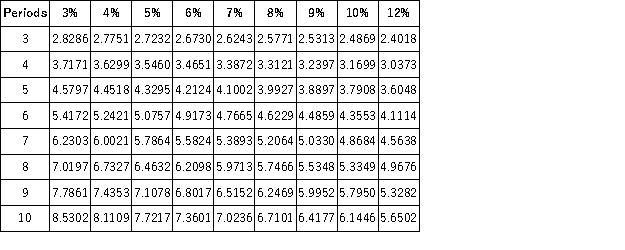

Present Value of an Annuity of 1  Future Value of an Annuity of 1

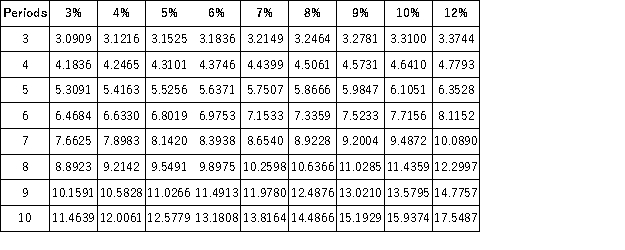

Future Value of an Annuity of 1  Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?

Marc Lewis expects an investment of $25,000 to return $6,595 annually. His investment is earning 10% per year. How many annual payments will he receive?

Definitions:

Option Expense

The cost associated with granting stock options to employees or executives, which companies must expense in their financial statements.

Fair Value Hedge

A hedging strategy aimed at protecting against the risk of changes in the fair value of an asset, liability, or an identified portion of such, that is attributable to a particular risk.

Foreign Exchange Risk

The potential for loss due to fluctuations in currency exchange rates affecting the value of foreign-denominated transactions and investments.

Mexican Pesos

The currency of Mexico, represented symbolically as MXN and used in financial transactions within the country.

Q11: During a home care visit the nurse

Q12: Can the advertising media,such as magazines,be held

Q13: In Morse v.Frederick,the "Bong Hits 4 Jesus"

Q14: The federal Sunshine Act applies only to<br>A)the

Q33: When consolidated financial statements are prepared, the

Q65: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q68: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q73: Define the foreign exchange rate between two

Q165: Tower, Knight, and Spears are partners who

Q167: Samuel organized a limited partnership and is