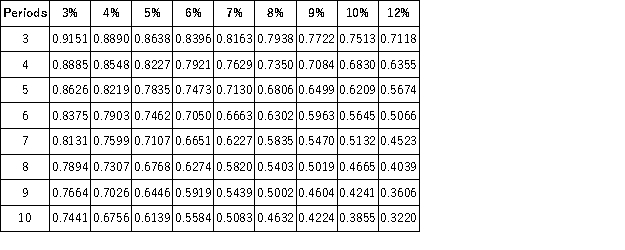

Present Value of 1  Future Value of 1

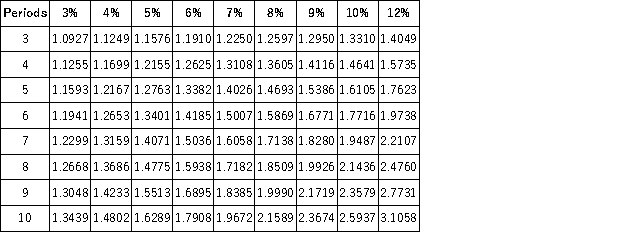

Future Value of 1  Present Value of an Annuity of 1

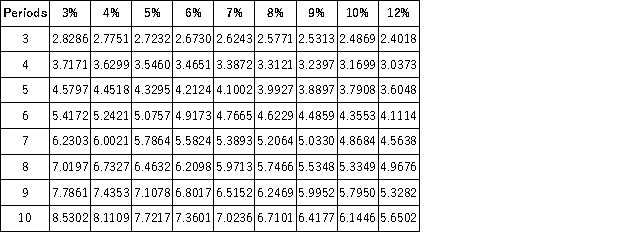

Present Value of an Annuity of 1  Future Value of an Annuity of 1

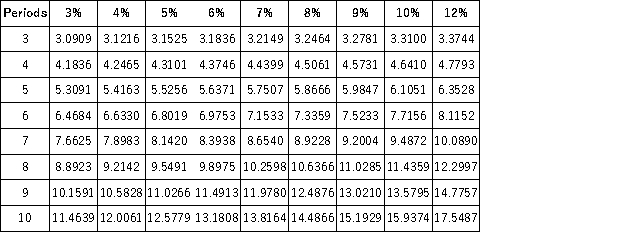

Future Value of an Annuity of 1  A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

A company needs to have $150,000 in 5 years, and will create a fund to insure that the $150,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $150,000 at the end of 5 years?

Definitions:

Invalid Argument

An argument whose conclusion does not logically follow from its premises, even if all the premises are true.

True Conclusion

An outcome of reasoning or argumentation that accurately reflects reality or fact.

Enthymeme

A categorical syllogism with an unstated premise or conclusion.

Unstated Premise

An implicit assumption or belief in an argument that is not expressed by its premises or conclusion.

Q4: In a lawsuit against you for disclosure

Q7: The nurse needs prepares to irrigate a

Q10: The nurse is determining which volume of

Q19: A client is prescribed ritonavir (Norvir)120 mg

Q20: The nurse is providing care to a

Q24: Which one of the following Supreme Court

Q100: NC Partnership has current year net income

Q107: When a partner leaves a partnership, the

Q121: What are the ways a partner can

Q215: Long-term investments in available-for-sale securities are reported