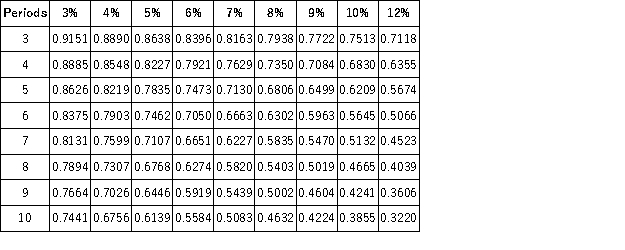

Present Value of 1  Future Value of 1

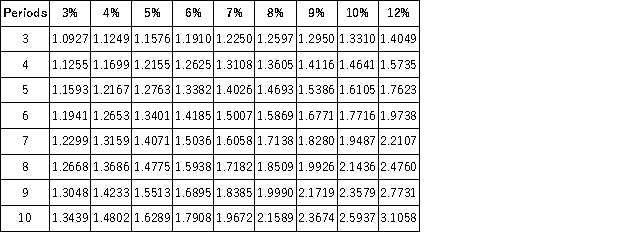

Future Value of 1  Present Value of an Annuity of 1

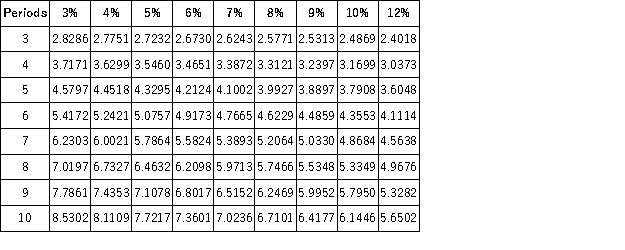

Present Value of an Annuity of 1  Future Value of an Annuity of 1

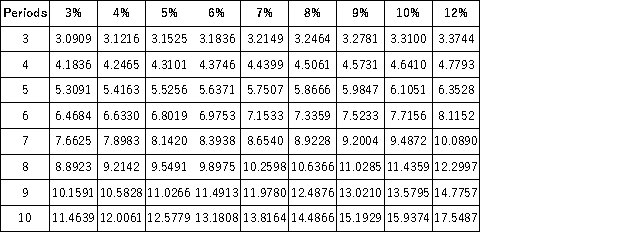

Future Value of an Annuity of 1  A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

A company is creating a fund today by depositing $65,763. The fund will grow to $90,000 after 8 years. What annual interest rate is the company earning on the fund?

Definitions:

Market Price

The current exchange price for an asset or service in the marketplace.

Discount Rate

The interest rate used to determine the present value of future cash flows or to discount future obligations.

Maturity

The predetermined date on which a financial instrument, loan, or security reaches its final payment, at which point the principal amount must be repaid.

Zero-Coupon Bond

A debt security that doesn't pay periodic interest, sold at a discount from its face value, and repays the face value at maturity.

Q4: A weaker substitute for a majority opinion

Q6: In Zamora v.Columbia Broadcasting System plaintiffs alleged

Q14: The healthcare provider suggests that a client

Q14: Regulatory power over broadcasting is the domain

Q16: The First Amendment itself<br>A)is a single sentence

Q21: One of the most common forms of

Q26: In MGM v.Grokster the U.S.Supreme Court in

Q34: A capital deficiency means that:<br>A)The partnership has

Q80: Trading securities are always reported as current

Q135: _ are debt and equity securities that