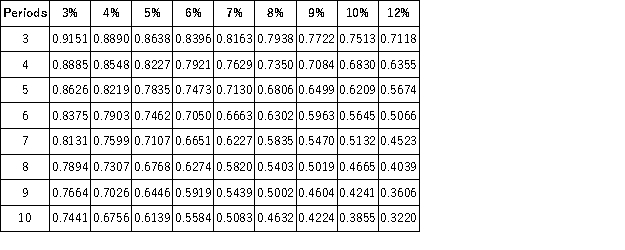

Present Value of 1  Future Value of 1

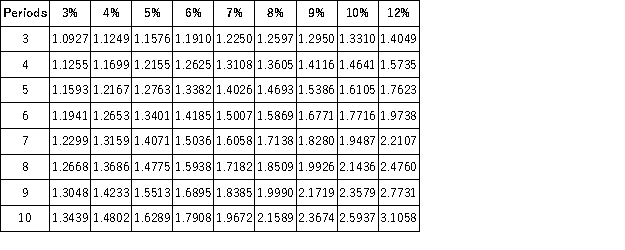

Future Value of 1  Present Value of an Annuity of 1

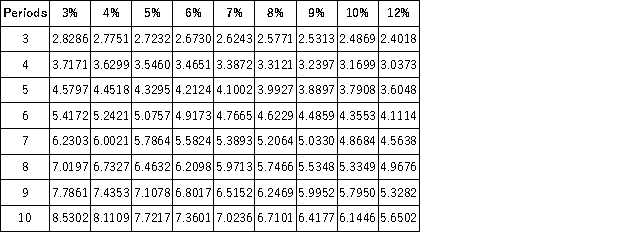

Present Value of an Annuity of 1  Future Value of an Annuity of 1

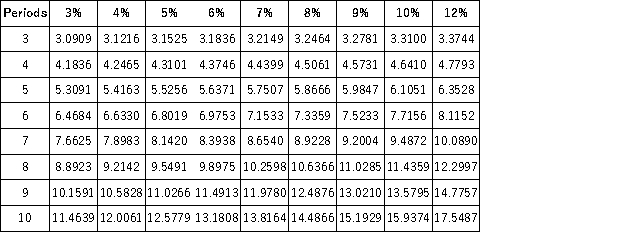

Future Value of an Annuity of 1  A company borrows money from the bank by promising to make 6 annual year-end payments of $27,000 each. How much is the company able to borrow if the interest rate is 9% compounded annually?

A company borrows money from the bank by promising to make 6 annual year-end payments of $27,000 each. How much is the company able to borrow if the interest rate is 9% compounded annually?

Definitions:

Specialization

A process wherein individuals or businesses focus on producing a limited range of goods or services to gain greater efficiency and productivity.

Trade

The swapping of goods, services, or both among two or more entities.

Opportunity Cost

The loss incurred from potential opportunities when one choice is made over others.

Absolute Advantage

A condition where a country, entity, or individual can produce a good or service more efficiently than competitors using the same amount of resources.

Q1: The two main performing-right organizations in the

Q3: Would your exclusion from the test viewing

Q4: A false-advertising claim under section 43(a)of the

Q7: By virtue of the due process clause

Q8: A 2 year old child is prescribed

Q15: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q15: Profit margin is net sales divided by

Q18: In the "Hit Man" case the book

Q109: Partnership accounting is the same as accounting

Q124: Arkansana Inc. imports inventory from Costa Rica.