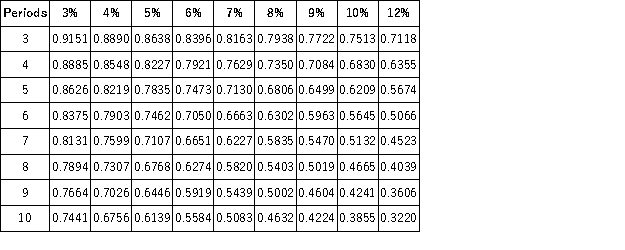

Present Value of 1  Future Value of 1

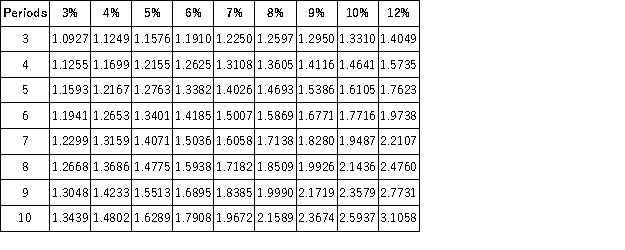

Future Value of 1  Present Value of an Annuity of 1

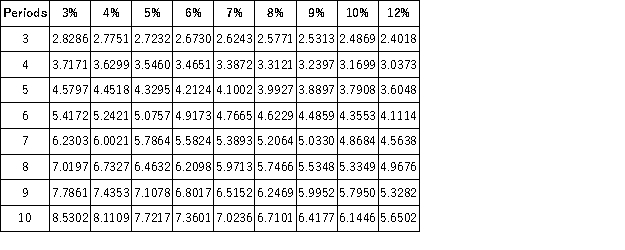

Present Value of an Annuity of 1  Future Value of an Annuity of 1

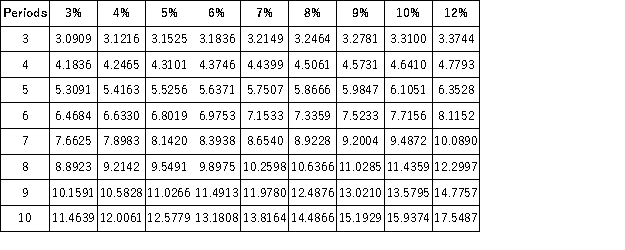

Future Value of an Annuity of 1  Giuliani Co. lends $524,210 to Craig Corporation. The terms of the loan require that Craig make six semiannual period-end payments of $100,000 each. What semiannual interest rate is Craig paying on the loan?

Giuliani Co. lends $524,210 to Craig Corporation. The terms of the loan require that Craig make six semiannual period-end payments of $100,000 each. What semiannual interest rate is Craig paying on the loan?

Definitions:

Restructuring

The process of reorganizing a company's structure, operations, or debt to improve efficiency or manage financial challenges.

Tax Effect

The impact of taxation on business decisions, investments, and net income, considering both current and future taxes.

DFL

Degree of Financial Leverage; a measure that evaluates the sensitivity of a company's earnings per share to fluctuations in its operating income, highlighting the impact of financial leverage.

DOL

Degree of Operating Leverage, a measure of a company's operating risk by quantifying how a change in sales affects its operating income.

Q4: Plaintiffs can win a civil trespass case

Q5: Present Value of 1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6316/.jpg" alt="Present

Q11: The Supreme Court laid the general foundation

Q15: The United States is composed of how

Q18: The nurse is providing care to a

Q101: A partnership has a limited life.

Q118: All of the following are true for

Q154: On January 2, Froxel Company purchased 10,000

Q197: Prepare a April 30 balance sheet in

Q207: On November 12, Higgins, Inc., a U.S.