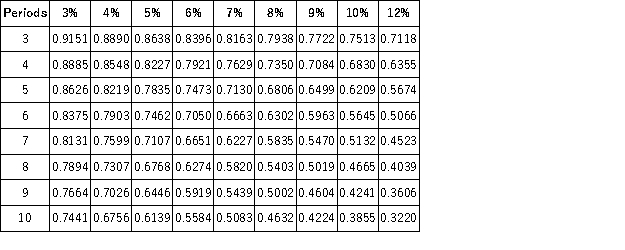

Present Value of 1  Future Value of 1

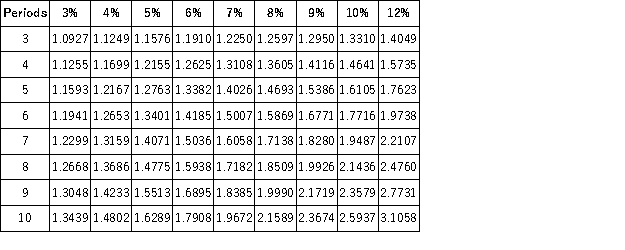

Future Value of 1  Present Value of an Annuity of 1

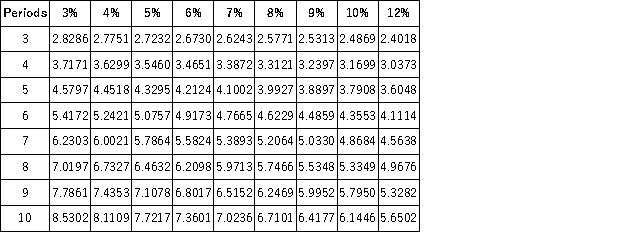

Present Value of an Annuity of 1  Future Value of an Annuity of 1

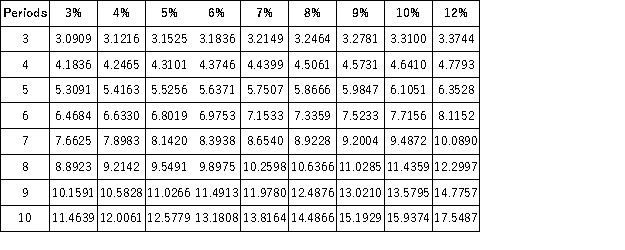

Future Value of an Annuity of 1  Milton Shirer has won the New York state lottery when the jackpot was $20 million. He has the options of taking the prize winnings as $2 million per year over the next ten years or a single payment now of $13,000,000. Which option should Milton choose based on present value principles and assuming an 8% annual interest rate compounded annually?

Milton Shirer has won the New York state lottery when the jackpot was $20 million. He has the options of taking the prize winnings as $2 million per year over the next ten years or a single payment now of $13,000,000. Which option should Milton choose based on present value principles and assuming an 8% annual interest rate compounded annually?

Definitions:

Logistics Manager

A professional responsible for overseeing the supply chain operations, ensuring efficient delivery of goods.

Retail Buyer

A professional responsible for selecting and purchasing goods for resale in retail outlets.

Ownership/Organization

Pertains to the legal right to possess something and the structure or arrangement of management and operations within an entity.

Level Of Service

The degree of quality and satisfaction a customer receives from a service provider.

Q11: The U.S.Supreme Court has ruled that headlines,considered

Q16: Copyright may be defined as<br>A)an automatic right

Q18: The nurse is preparing to administer medication

Q19: The key justification for the Supreme Court's

Q22: There are three major types of business

Q23: The federal Trademark Act of 1946 is

Q25: Recording of conversations is allowed under the

Q107: Unrealized gains and losses on trading securities

Q116: Mutual agency means<br>A)Creditors can apply their claims

Q124: Arkansana Inc. imports inventory from Costa Rica.