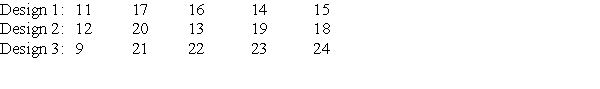

Fifteen stores were selected to test the effects of three different designs for packaging a tablet on sale. Five stores each were randomly assigned to design 1, 2, or 3. The data below provide the sales over a one-week period.  The marketing team decided not to use ANOVA to test whether the three different designs had the same effect on sales or whether sales were increased by some designs over others. The hypotheses to be tested are:

The marketing team decided not to use ANOVA to test whether the three different designs had the same effect on sales or whether sales were increased by some designs over others. The hypotheses to be tested are:

Definitions:

Accounts Receivable

Outstanding payments due to a company from its clients for delivered goods or services awaiting compensation.

Direct Method

A cost allocation method that assigns service department costs directly to production departments without intermediate steps.

Income Statement

A financial statement that shows a company's financial performance over a specific period, detailing revenues, expenses, and net income.

Income Taxes Payable

A current liability account found on the balance sheet that represents the amount of income taxes owed to governmental authorities but not yet paid.

Q2: Running times for 400 meters are Normally

Q8: A study of obesity risk in children

Q9: Applicants looking for a job at a

Q13: A sociologist studying freshmen carried out a

Q15: A marketing researcher was studying the effect

Q19: Let A be the event that a

Q26: An economist conducted a study of the

Q30: The exam scores (out of 100 points)

Q31: A nutritionist has designed an intervention to

Q174: Suppose there is a decrease in short-run