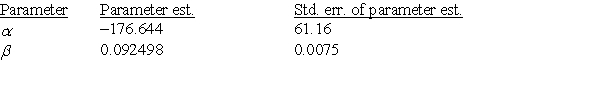

A random sample of 19 companies from the Forbes 500 list was selected, and the relationship between sales (in hundreds of thousands of dollars) and profits (in hundreds of thousands of dollars) was investigated by regression. The following simple linear regression model was used: profits = + (sales) , where the deviations were assumed to be independent and Normally distributed, with mean 0 and standard deviation . This model was fit to the data using the method of least squares. The following results were obtained from statistical software. r2 = 0.662

S = 466.2  The approximate slope of the least-squares regression line is:

The approximate slope of the least-squares regression line is:

Definitions:

Departmental Contribution

The amount of income earned by a specific department after direct costs associated with the department have been subtracted.

Overhead

The ongoing administrative, general, and maintenance expenses incurred during the production process, not including direct labor or materials costs.

Profit Centers

Parts of an organization that are responsible for generating revenue and evaluated based on their profitability.

Return on Investment

A performance measure used to evaluate the efficiency or profitability of an investment, calculated as net profit divided by the cost of the investment.

Q1: Which of the following is an advantage

Q4: A marketing researcher was studying the effect

Q6: Suppose a flu epidemic is sweeping a

Q12: The Kruskal-Wallis test is best described as:<br>A)a

Q25: You toss a thumbtack 100 times and

Q29: In order to investigate treatments for morbid

Q61: As compared to government spending, spending generated

Q64: Assuming that the substitution effect is large

Q70: Which of the following controls is most

Q124: Which of the following might explain a