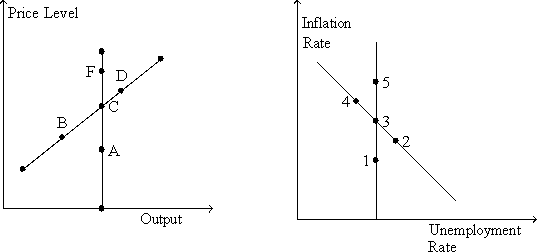

Figure 17-6

Use the two graphs in the diagram to answer the following questions.

-Refer to Figure 17-6. Starting from C and 3, in the long run, an increase in money supply growth moves the economy to

Definitions:

Internal Rate Of Return

A financial metric used to evaluate the profitability of an investment, calculated as the discount rate that makes the net present value (NPV) of all cash flows from the investment equal to zero.

Discount Factor(s)

A multiplier for determining the present value of future cash flows or other investments, reflecting the time value of money.

Simple Rate Of Return

A method to calculate the profitability of an investment by dividing the annual incremental net operating income by the initial investment cost.

Straight-Line Depreciation

A method of calculating the depreciation of an asset by evenly spreading its cost over its useful life.

Q15: Means-tested government benefits base benefits on<br>A) a

Q31: The stemplot below displays midterm exam scores

Q61: Which of the following statements is correct?<br>A)

Q96: Which inflation costs could the government take

Q182: Which of the following would not be

Q204: A policymaker in favor of stabilizing the

Q276: A shock increases the costs of production.

Q306: Because the liquidity-preference framework focuses on the<br>A)

Q353: Refer to Figure 17-5. Curve 2 is

Q356: For the U.S. economy, which of the