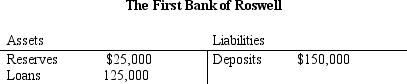

Table 11-4.

-Refer to Table 11-4. If the bank is holding $4,000 in excess reserves, then the reserve requirement with which it must comply is

Definitions:

Proportional Tax

A tax system where the tax rate remains constant regardless of the taxpayer's income level, meaning everyone pays the same percentage of their income.

Tax Schedules

Detailed tables or charts provided by tax authorities that dictate the tax rates applicable to different levels of taxable income or types of taxpayers.

Taxable Income

The amount of income used to calculate how much tax an individual or a company owes to the government, after deductions and exemptions.

Progressive Tax

A taxation system where the tax rate increases as the taxable income increases, typically placing a higher burden on higher-income earners.

Q23: When the value of money is on

Q75: Suppose some country had an adult population

Q157: In Ugoland, the money supply is $8

Q257: Every month, the Bureau of Labor Statistics

Q278: The Bureau of Labor Statistics places people

Q329: What does the text mean by the

Q331: The discount rate is<br>A) the interest rate

Q352: When a bank loans out $1,000, the

Q396: M1 includes<br>A) currency.<br>B) demand deposits.<br>C) traveler's checks.<br>D)

Q410: Suppose there are a large number of