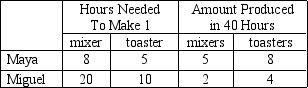

Table 3-6

Assume that Maya and Miguel can switch between producing mixers and producing toasters at a constant rate.

-Refer to Table 3-6.Miguel has an absolute advantage in the production of

Definitions:

Form 1116

Form 1116 is used by taxpayers to claim the Foreign Tax Credit, which is a credit for income taxes paid to a foreign country, reducing the U.S. tax liability on foreign income.

Foreign Tax Credit

A tax credit that allows taxpayers to offset income taxes paid to foreign governments against their U.S. tax liabilities, to avoid double taxation of the same income.

Earned Income Credit

The Earned Income Credit (EIC) is a refundable tax credit for low- to moderate-income working individuals and families, particularly those with children, to reduce poverty and encourage work.

Nonrefundable Credit

A tax credit that can only reduce a taxpayer’s liability to zero, but unlike refundable credits, any excess is not paid out to the taxpayer.

Q150: When economists make<br>A) positive statements, they are

Q188: Refer to Table 3-2. Aruba has a

Q190: Which of the following is an example

Q199: In conducting their research, economists face an

Q220: Refer to Figure 2-6. This economy has

Q220: If the demand for movies increases at

Q299: Refer to Table 3-6. The opportunity cost

Q358: Economic models<br>A) cannot be useful if they

Q362: Refer to Figure 3-6. Suppose Daisy decides

Q497: For an economist, the idea of making