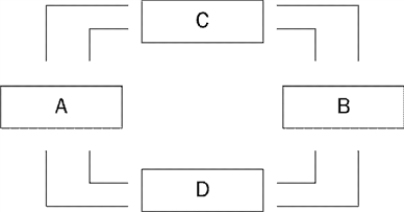

Figure 2-2

-Refer to Figure 2-2.Devin works as an attorney for a corporation and is paid a salary in exchange for the legal services he performs.Juan owns office buildings and rents his buildings to companies in exchange for rent payments.If Devin's income is represented by a flow of dollars from Box D to Box B of this circular-flow diagram,then Juan's income is represented by a flow of dollars

Definitions:

Income

Payment received, often on a consistent schedule, for employment or from investment profits.

Marginal Ordinary Income Tax Rate

The percentage of tax applied to your income for each tax bracket in which you qualify, increasing progressively as your income surpasses threshold amounts.

Qualified Dividends

Dividend payments received on shares of a corporation, taxed at a lower tax rate than regular income.

Tax Rate

The percentage at which an individual or corporation is taxed.

Q31: Refer to Figure 3-7. The opportunity cost

Q89: Refer to Table 3-4. The rancher has

Q98: Refer to Table 3-4. Assume that the

Q135: If one producer is able to produce

Q171: When calculating the cost of college, which

Q224: In the markets for the factors of

Q304: Which of the following is correct concerning

Q456: The effects of borrowing by the federal

Q480: The two loops in the circular-flow diagram

Q518: An assumption an economist might make while